Buying your First Home in Kingaroy, Chinchilla or Roma?

First Home Buyers in Kingaroy, Chinchilla and Roma

If you're looking to buy a house and you've never done it before, it can feel like a daunting task, but your local Mortgage Choice broker, Aaron Fahy can help you! Aaron understands our community and the market conditions where we live and is here to get to know you and provide straightforward advice that best meets your individual needs.

As your mortgage broker, Aaron takes the time to search through hundreds of home loans from our lenders to find the one that suits you. We’ll also help you determine if you're eligible for any concessions, as well as prepare the loan application on your behalf and follow it through to settlement, keeping you up to date along the way.

If you're putting off buying purely because you think it's more expensive than renting, then please reach out to our team this week. We'd love to help you purchase your own home! Get in contact with Aaron Fahy this week by calling him on 0430 479 912 or emailing him by clicking the button below.

Start your home loan journey today

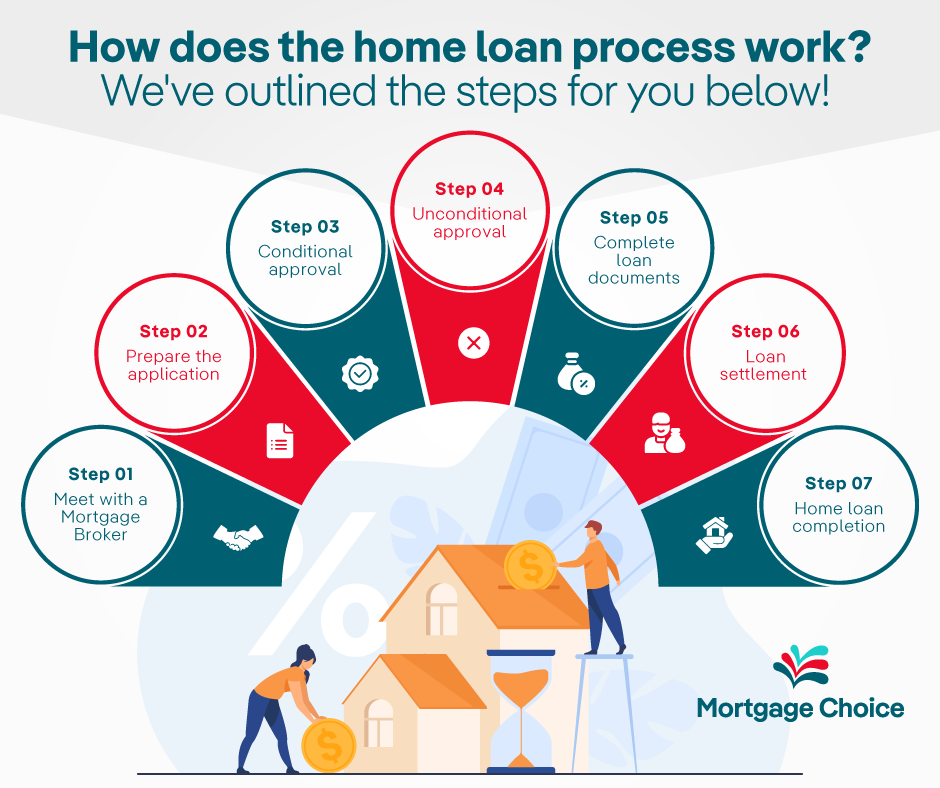

How does the home loan process work?

Once we have found a suitable home loan that suits your needs, the next step is to submit an application. The process varies between lenders, but to help you understand the process, we’ve provided a general order of events below.

Step #1: Meet with a Mortgage Broker

We'll meet with you to understand your financial & lifestyle goals. We'll search through hundreds of home loans to find the one that's right for you, calculate your borrowing power, work out repayments and answer any questions that you may have.

Step #2: Prepare the application

Once we've helped you choose the loan that's right for you, we'll help you prepare the application and guide you through the process.

Step #3: Conditional approval

The lender will provide conditional approval while they organise the property valuation and conduct a credit check. We'll stay in touch with the lender and keep you informed along the way.

Step #4: Unconditional approval

Unconditional (full) approval is formal acknowledgement that your home loan application has been approved.

Step #5: Complete loan documents

Your loan is both a significant financial commitment and a strong financial foundation.

Once your loan documents arrive, we'll organise a time to meet and help you complete the document.

Step #6: Loan settlement

If you're purchasing a property, your solicitor / conveyancer will organise settlement directly with the lender, according to the settlement date on the contract of sale. If you're refinancing your existing home loan, the lenders will liaise directly to exchange the documents.

Step #7: Home loan completion

Keeping in touch: our service doesn't end once your loan settles. We will stay in touch to make sure your home loan is the right solution for your needs now and in the future.

To organise your appointment, contact Aaron Fahy on 0430 479 912.

We can also help you with:

- Mortgage Brokers Kingaroy

- Mortgage Brokers Chinchilla

- Mortgage Brokers Roma

- Refinancing

- Property Investment