January 05, 2021

Australian homeowners rank paying off their mortgage as their greatest life priority yet over 50% don't know the exact current interest rate on their home loan, new research shows.

The research commissioned by Mortgage Choice found a disconnect between the increased financial concerns borrowers are experiencing from COVID-19 and knowledge of whether their interest rate is competitive. A lower interest rate can help borrowers pay off their loan faster or put extra money in their pocket.

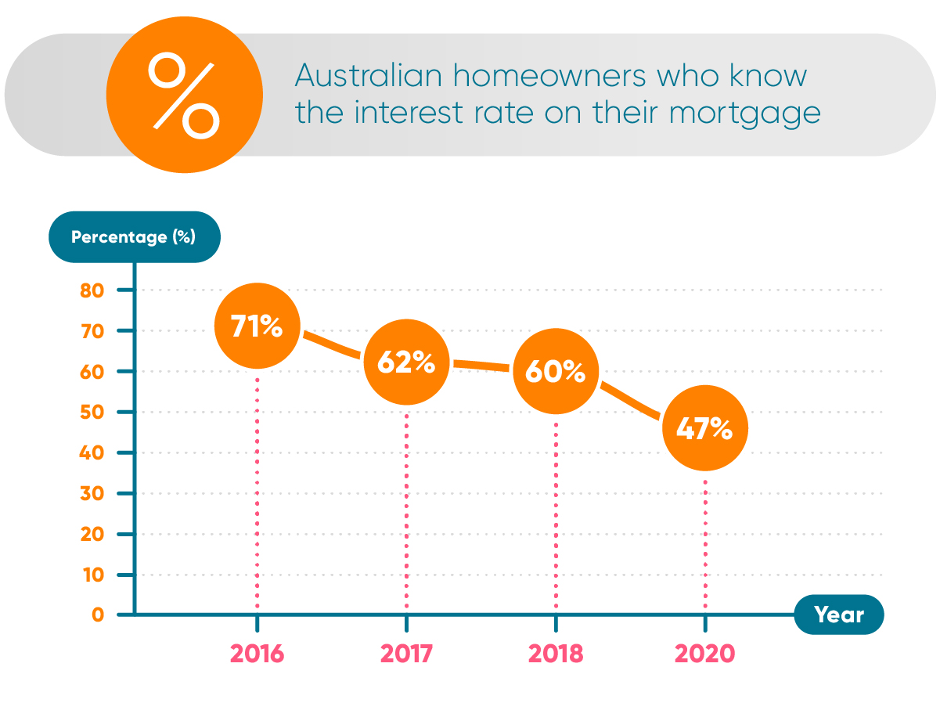

Only 46.5% of respondents knew their current interest rate. Mortgage interest rate apathy appears to be increasing, with fewer Australians knowing their rate in 2020 compared to previous surveys commissioned by Mortgage Choice (61.5% in 2018 and 71% in 2016).

This increased complacency comes at a time when the coronavirus pandemic has put more people under financial pressure. Over 62% of Australians admit that COVID-19 has caused them to worry more about money, with 65.6% trying to boost their resilience by saving more, spending less and improving their financial knowledge.

Susan Mitchell, Chief Executive Officer, Mortgage Choice, said, "Our research suggests that Australians are more focused than ever on their finances, yet many are being complacent with their biggest expense and potentially biggest saving. There has never been a better or more important time for all Australians to take charge of their financial wellbeing.”

Homeowners aged 30 to 39 were the most likely to not know their interest rate (64.5%), with those aged 50 to 59 years close behind at 56.4%.

"It's so important to know your interest rate because if you’ve been complacent the chances that you are paying too much are extremely high. Every Australian should make it a New Year resolution to review their home loan. Give yourself an early Christmas present by reducing your rate and saving on repayments.”

However, Australians are not keeping track of interest rates or checking to see if they are getting the best deal. Asked how often they review their home loan, 13.7% said never, and 44.4% said every couple of years. Even fewer (41.9%) review their loan annually.

“I strongly encourage all borrowers who haven’t had their loan reviewed in the last 24 months to speak to their broker or their lender to learn if they’re still in a competitive home loan," added Ms Mitchell.

"In the past year alone, the cash rate has dropped by 65 basis points, and many lenders are open to negotiating on rate reductions. Let's say your principal and interest rate is 3.99% and shopping around with the help of a mortgage broker enables you to drop by 50 basis points to 3.49%. On a 30-year home loan of $600,000, the savings could be in the vicinity of $170 a month."

"At this time of year many of us will start setting new fitness goals and find a personal trainer or sign up for online fitness classes. I urge any borrowers who may be neglecting their home loan to keep the same mindset when it comes to their financial wellbeing. An experienced mortgage broker can help you get your home loan in shape and the great thing is, you don’t have to do the exercise yourself! Don’t put it off any longer, make an appointment to speak to your local Mortgage Choice broker today so you can put your best foot forward in 2021," concludes Ms Mitchell.

About the research

The Mortgage Choice research is based on research commissioned by Mortgage Choice and conducted by CoreData between 14 and 27 October 2020. The research was conducted via a quantitative online survey, gathering a total of 1,023 responses from Australians across the country aged between 21 and 60 years old who are either a ‘First home buyer’ (494 respondents) or a ‘Homeowner/Investor’ (529 respondents).