E-guides & Resources from the Gippsland team | Sale, Traralgon & Warragul

Download our free comprehensive e-guides to help guide you on your next step on the property ladder. From buying your first home, building your home to investing in property, our e-guides will talk you through each step.

And don't forget to check out our:

- Range of property & finance FAQ videos

- Home Loan Calculators so you can do the basic sums

- Read: Are you a first time property investor?

- Read: The basic questions for first home buyers

Step by Step Guide to: property | Sale & Warragul

Looking for some more information on the home ownership journey? Our free e-guide will take you through how to get ready to buy, the home loan process, a glossary of commonly used terms and more. Download your own copy from Mortgage Choice in Sale. Do some quick sums with our home loan calculators.

Guide to: Refinancing your loan | Sale & Warragul

Refinancing involves paying out your current loan with a new one and could save you money on your interest or reduce your loan term. But there's plenty to consider. Our free e-guide will take you through the pros and cons of refinancing as well as the cost and process. Download your copy from Mortgage Choice in Sale. Find out more about our refinancing services.

Guide to: buying your first home | Sale and Warragul

Buying your first home is such an exciting step. The first thing to do is to find out more about your borrowing capacity and possible repayments. Our e-guide will talk you through your options for your first home, and the steps required for purchase. Read: how we helped Abbey purchase her first home.

Factsheet: The First Home Loan Deposit Scheme

Download our free factsheet from Mortgage Choice in Sale on the First Home Loan Deposit Scheme. This scheme was announced by the government as a way to help first home buyers purchase - and you can buy your first home with just a 5% deposit. More spaces for this scheme were opened on 1-July 2020, but hurry! Spaces are limited. Click here to read more about eligibility for the First Home Loan Deposit Scheme.

Guide to: property investment | Sale & Warragul

When preparing to invest in property, it's important to understand the finance behind your new purchase. Our e-guide will take a closer look at the additional costs for investments, how to select your investment strategy and more. Download your own copy from Mortgage Choice in Sale.

Guide to: building or renovating | Sale & Warragul

Building or renovating your home can be a fantastic way create your dream living space. Our free e-guide will help you take a closer look at the costs of building, how to manage your costs during construction and the best strategies to minimise interest. Download your copy from Mortgage Choice in Sale. Do some quick sums with our home loan calculators.

Factsheet: Buying off the plan | Mortgage Choice Sale

Buying off the plan properties is a popular option but it’s not without pitfalls. That's why our team of Mortgage Brokers in Sale have created this Factsheet to guide you through the enitre process.

Download now

Factsheet: The HomeBuilder Cash Grant | Mortgage Choice in Sale

Download our free factsheet from the team at Mortgage Choice in Sale on the latest HomeBuilder Cash Grant. This grant was announced by the Government recently, to help support the residential building industry during COVID-19 More changes have recently been announced! Stay updated in our blog on the HomeBuilder grant.

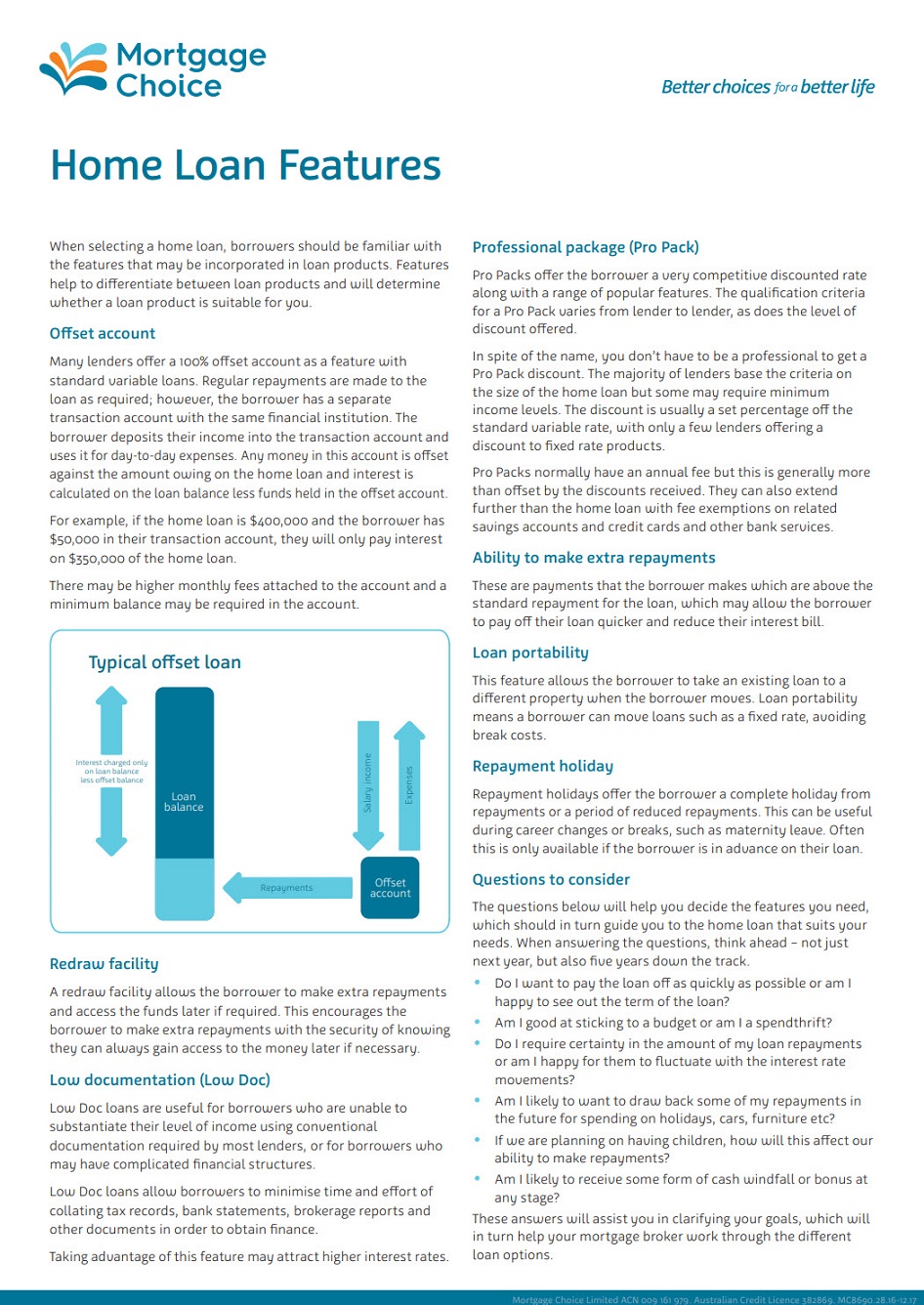

Factsheet: Home Loan Features | Sale & Warragul

There are a wide variety of home loan features available that can save you significant interest on your home loan, or provide you with the flexibility you want. Features an offset account, the ability to make extra repayments, a repayment holiday, loan portability and more can give you a strategic edge. Find out more about the basic features of your home loan with our free factsheet from Mortgage Choice in Sale. Read: In a fix about whether to fix?

Guide to: buying your next home | Sale & Warragul

As an existing home owner looking to move to their next property, you have a wider range of finance options that when you first purchased. Our e-guide will take you through the things you need to know for your next steps. Download your copy from Mortgage Choice in Sale. Read: In a fix about whether to fix?

Guide to: conveyancing | Sale & Warragul

Conveyancing is a often misunderstood part of the home loan process. But in reality, conveyancers can help you ensure that the purchase contracts are in order and minimise your risk. Our free e-guide from Mortgage Choice in Sale will take you through the conveyancing process and how they can help.

Factsheet: Self Managed Super Fund Lending | Sale & Traralgon

Before making a Self Managed Super Fund investment, it is important you understand the risks associated. To get started on your research download our quick factsheet with the important points you will need to know about SMSF from Mortgage Choice in Sale.

Moving home checklist

We helped you secure your finances, now let us help you with the move!

Guide to: Understand Guarantors | Mortgage Choice in Sale

Are you considering having a guarantor for your first home purchase? There's a lot to consider, for both you and your potential guarantor. Make sure you have all the facts! Download your free e-guide on guarantor loans from Mortgage Choice in Sale. Do some basic home loan sums with our calculators.

Guide to: Negotiating To Buy | Mortgage Choice in Sale

A helpful guide with hints and tips on negotiating to buy a property.

Factsheet: The costs associated with buying a property | Mortgage Choice in Sale

Buying a property is more than just about the deposit. There are other costs you will be liable for. It's important to know what you will need to budget before your purchase is final. Download our free factsheet on the costs of buying a property from the Mortgage Choice in Sale & Gippsland. Do some quick home loan sums with our calculators.