Investing in the Queensland property market can have many benefits, depending on what your goals are. As Queensland is a large state with many different regions and lifestyles, it is likely that an area is right for your investment journey.

Property Investment Queensland Update 2022

Queensland Housing Market

The Queensland property market is currently experiencing a boom across all regions. In February 2021, property reports from CoreLogic indicated that almost every region in Queensland saw growth in prices - with Townsville the only region to see a 0.6% decrease3.

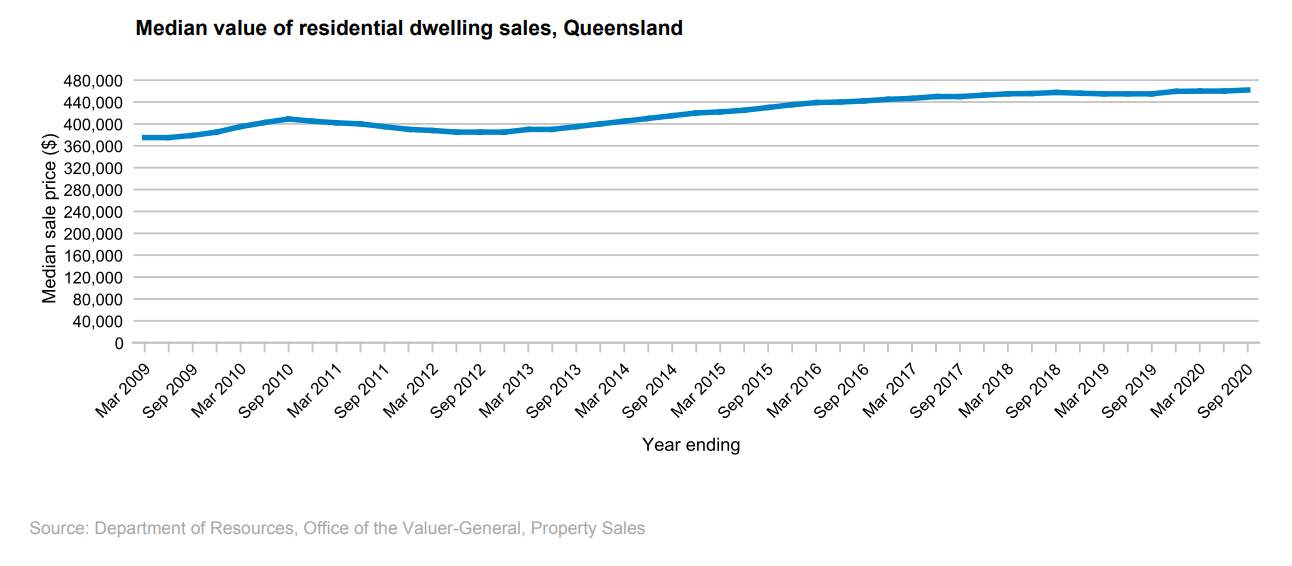

Historically, the median sale prices of properties in Queensland have been quite stable with a gradual increase over time. The below graph4 shows that over the 11 year period from March 2009-September 2020 the median prices in Queensland have increased from approximately $375,000 to $462,000 with a growth rate of around 2.21%.

Unlike other states in Australia, Queensland’s housing market defied the economic predictions caused by the COVID-19 pandemic and managed to thrive in 2020. In her December 2020 Quarter analysis, REIQ CEO, Antonia Mercorella highlighted that the rise in prices and interest in Queensland’s property market can be attributed to strong interstate migration, especially in areas such as Sunshine Coast and Gold Coast5. This boom has resulted in the property market for 52 out of 56 (93%) regional Local Government Areas (LGAs) recording positive annual growth.

Planning to invest? Get your free home loan quote today.

Get startedQueensland Economy and Infrastructure

As with cities and countries all over the world, Queensland’s economy was heavily impacted by the Coronavirus Pandemic. This was evident with the unemployment rate hitting a peak of 8.8% in July 2020, the highest unemployment rate the state experienced since hitting 9.0% in May 20016.

Despite setbacks from the global pandemic, Queensland’s economy is worth more than $360b and over the past 2 decades, it’s economic growth has generally exceeded the national average7. The strong economic growth can be attributed to trends such as strong population growth, a resource investment boom and increases in LNG exports. This put Queensland in a good position going into the COVID-19 economic downturn and allowed the government to act quickly and maintain a well executed recovery plan.

Queensland’s response to COVID-19 has resulted in a positive impact to the economy going into 2021, through being the first state to recover all jobs lost during the pandemic8 and having a forecasted increase to the economy of 4.6%9.

Queensland’s economic recovery plan includes major developments to the infrastructure across all areas in the state. With a $56b, four-year, infrastructure guarantee, the Queensland government has announced projects that are set to have great impacts in all of the states regions.

Some of the larger projects planned to begin or continue in 2021 include:

These infrastructure projects will help create thousands of jobs all over Queensland during construction and once complete will improve the livability in regions across the state, making now a great opportunity to look at investing in these areas.

Property investor guide

Our free, downloadable guide explains the costs and steps associated with the purchase of an investment property, positive/negative gearing as well as pros and cons of houses vs. units.

Best Areas in Queensland to Invest

Queensland Investment Property Taxes

When buying an investment property in Queensland there are some tax considerations that you will need to consider when first purchasing your investment property. In Queensland, you will need to pay transfer (stamp) duty on any property that you purchase. You can use our handy calculator to understand more about transfer duty and how much you may need to pay here.

You will also be required to pay land tax on your property each year if your property is worth $600,000 or more. Visit the Queensland Office of State Revenue website for more here.

We are here to help

If you’re looking to purchase an investment property and you think Queensland is the right market for you, speak to your local Mortgage Choice broker to understand what you can afford and what location may be right for you.