Investing in the Victorian property market can have many benefits, depending on what your goals are. As VIC is a large state with many different regions and lifestyles, it is likely that an area is right for your investment journey.

Property Investment Victoria Update 2022

Victoria Housing Market

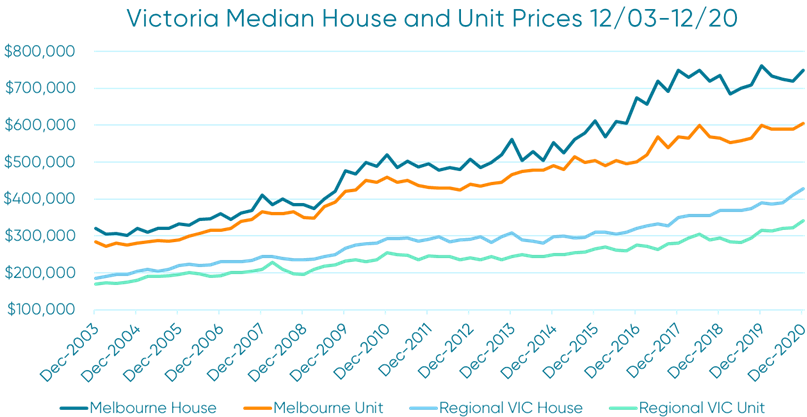

Historically Victoria’s property market has maintained steady growth in house and unit prices across the state. While Melbourne has maintained the strongest performance, especially in their housing market, 2020 saw a great opportunity for those looking to enter a more affordable market in the growth of Regional Victoria.

While Melbourne’s housing market saw a decrease in median prices of 1.57% and a minimal increase of 0.83% in unit prices from December 2019-2020, the rest of Victoria saw increases in their house and unit markets of 8.88% and 7.95%, respectively, in the same period.3 This boost for regional Victoria can be attributed to the impacts of coronavirus in Melbourne and the growing presence of a working from home culture as people were in search for more affordable and spacious homes.

Source: Median price (unstratified) and number of transfers (capital city and rest of state)

Source: Median price (unstratified) and number of transfers (capital city and rest of state)

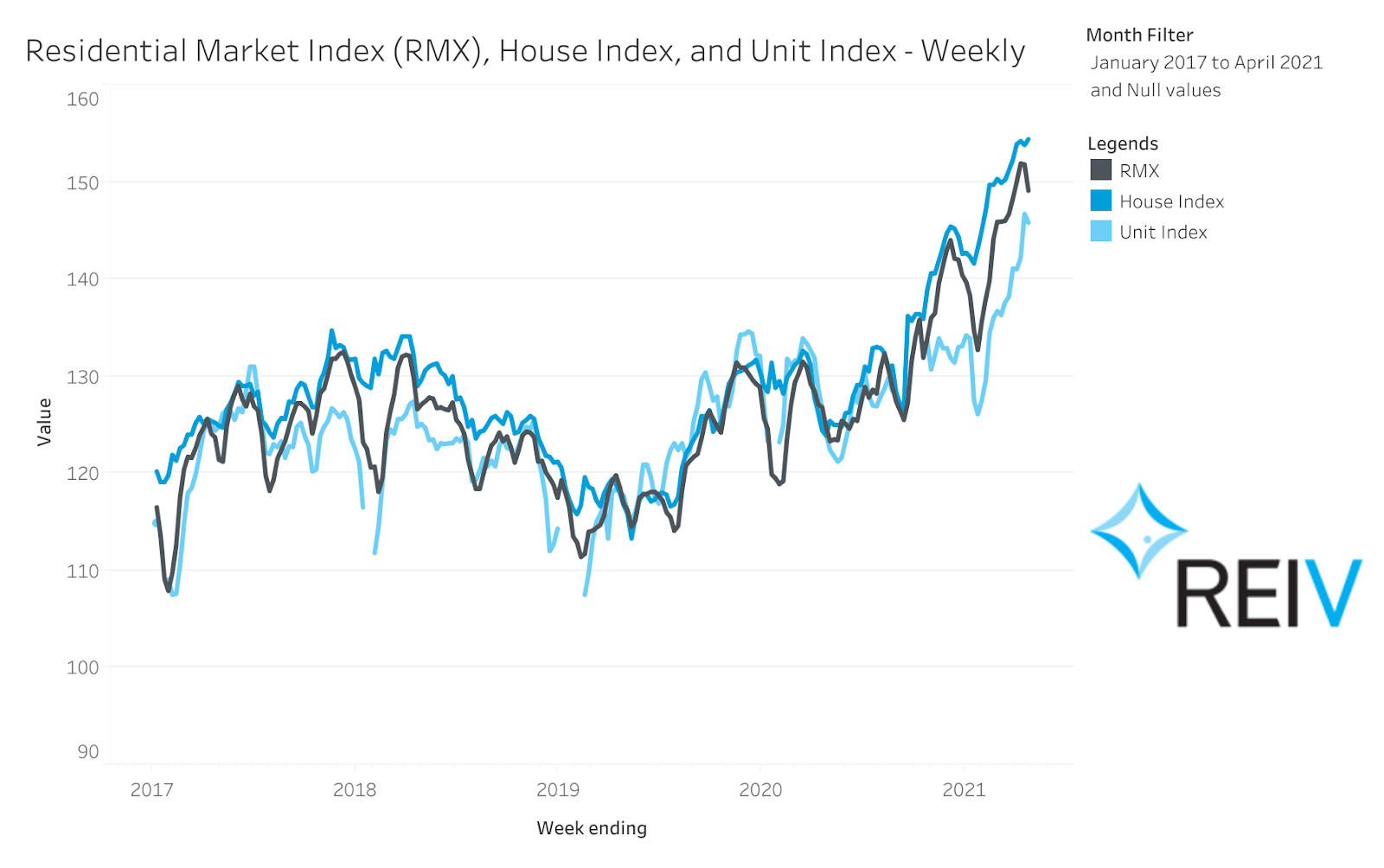

After an unpredictable period for the housing market in 2020, which saw Victoria experience the longest lockdown period of any state in Australia, 2021 is showing a more positive trend across the state. Using REIV’s Residential Market Index (RMX), we are able to understand the current trends of Victoria’s housing market.

As the below graph4 shows since January 2021 Victoria’s overall property market is seeing strong growth, led predominantly by house prices as they reached their highest point on record of 154.4. In 2021, the price index for units also achieved its highest point of 146.7 in the week ending April 18. From 2017, the RMX can be used to understand the fluctuation of the overall Victorian housing market to have an understanding of the seasonality and trends in property prices for the state.

Source: https://reiv.com.au/property-data/rmx

Source: https://reiv.com.au/property-data/rmx

There could be more gains to come. Westpac’s May Housing Pulse report5 forecasts property prices could rise 15% in 2021, slowing to 5% in 2022.

Planning to invest? Get your free home loan quote today.

Get startedVictoria Economy and Infrastructure

Prior to 2020, the Victorian Economy was experiencing extended periods of growth. As Australia’s second biggest economy, Victoria made up 23.6% of Australia’s Gross Domestic Product (GDP) and 26% of all employed workers in Australia.6 In December 2018 the unemployment rate in Victoria fell to its lowest point since August 2008, a 10-year low of 4.2%.7 However, during the peak of the coronavirus pandemic the unemployment rate began to rise, reaching its peak in June 2020 at 7.5%.8

Despite the major setbacks to the economy in 2020, Victoria’s economy is forecasted to achieve 5.3% growth - the strongest of any other state!9 Victorian Treasurer Tim Pallas has highlighted Victoria’s expected recovery attributing it to the Government’s focus on “investing in employment support across Victoria, together with our record pipeline of infrastructure projects.”10

With 68 projects currently in Victoria’s infrastructure pipeline11 - 17 stated to have a state-wide impact - it is clear that improving the State’s infrastructure is a high priority for the Government. A boost to this pipeline of development has come from the 2020-21 Victorian budget allocating $10 billion for better roads and public transport.12

Key transport infrastructure projects in 2021 include:

Property investor guide

Our free, downloadable guide explains the costs and steps associated with the purchase of an investment property, positive/negative gearing as well as pros and cons of houses vs. units.

Best areas in Victoria to invest:

Investing in Regional Victoria 2021

As mentioned above, 2020 saw strong growth rates for the property market in Regional Victoria. The data released for 2021 shows that Regional Victoria is continuing this upward trend as the median property price experienced a 4.1% quarterly increase in the March 2021 quarter.17

As discussed above Victorian regional centres Geelong and Bendigo are some of the contributing factors to the overall growth in Regional Victoria’s housing market as the rental demand is increasing. Overall Regional Victoria is currently an affordable and appealing option for investors as the average rental yield is 4.0% for Regional Victoria, compared to 2.7% for Metro Melbourne.18

Victoria Investment Property Taxes

When buying an investment property in Victoria there are some tax considerations that you will need to consider. In Victoria, you will need to pay transfer (stamp) duty on any property that you purchase. You can use our handy calculator to understand more about stamp duty and how much you may need to pay here.

When purchasing a property in Victoria, you may also need to pay any outstanding land tax on the property. You can apply for a property clearance certificate to see if there is any land tax owed on the property you are looking to purchase and, if so, how much. Once you own your property, it is important to understand that land tax is then payable annually if your property’s value exceeds $250,000. You can find the full list of land tax rates on the State Revenue’s website here.

We are here to help

If you’re looking to purchase an investment property and you think Victoria is the right market for you, speak to your local Mortgage Choice broker to understand what you can afford and what location may be right for you.