Since 2002 Melbourne has consistently ranked in the world’s top three livable cities by the Economist Intelligence Unit’s (EIU) Global Liveability Index, even taking out the top spot for 7 consecutive years from 2011 to 20171. This achievement has made Melbourne an ideal location for international and national migration and has resulted in the demand for the city to steadily increase every year.

Melbourne Property Investment Update 2022

Melbourne Housing Market

When investing in property, an understanding of a location's housing market in relation to current and previous trends can be beneficial. Melbourne’s property market has historically been one of the top performers in Australia.

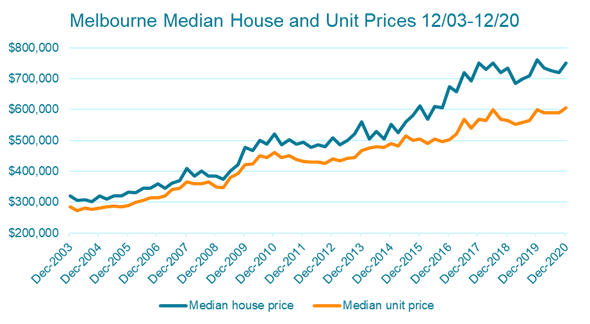

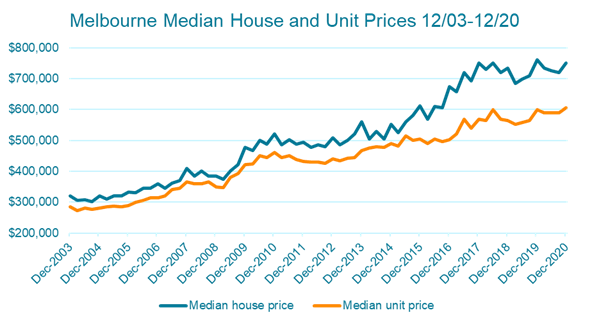

The popularity of living in Melbourne can be reflected in the median house and unit prices of the city as shown below. From December 2003 to 2020, both the house and unit prices in Melbourne have experienced significant growth with houses increasing from $320,000 to $750,000 and units seeing an increase from $285,000 to $605,000.

Source: Median price (unstratified) and number of transfers (capital city and rest of state)

Source: Median price (unstratified) and number of transfers (capital city and rest of state)

Of course, 2020 was particularly rough for Melbourne as it experienced the longest lockdown period of any capital city in Australia. This resulted in the median house price seeing a 1.57% decrease in December 2020, compared to December 20194. However, despite the decrease in median house prices, units in Melbourne managed to see a 0.83% increase over the same period.

Despite a difficult time in Melbourne in 2020, the resilience of the property market has been evident as in early 2021 we are starting to see an upward trend in the market. Following the trends of other capital cities, in April 2021 Melbourne’s housing market is recording a 1.29% growth month on month on Corelogic’s Home Value Index5.

This steady recovery and resilience to COVID-19 in Melbourne’s housing market can be attributed to many factors such as the historic low interest rates, mortgage repayment holiday options during the peak of COVID-19 and extension of the JobKeeper program by the Federal Government.

Based on the historical data and current market trends, we can expect to see the Melbourne property market continue to grow. A recent report by ANZ has forecasted that property prices are expected to increase by 16% in Melbourne in 20216 - its strongest growth year since the 1980s. This makes now a great time to enter the market by investing in property in Melbourne.

Planning to invest? Get your free home loan quote today.

Get startedMelbourne Economy and Infrastructure

Being the state capital, Melbourne is the central hub of Victoria when it comes to business, culture and recreational activities. With a booming economy, Melbourne’s 3 biggest industries are finance, IT and hospitality and in 2019 the city contributed to 7% of Australia’s total economy7.

As Melbourne endured the longest lockdown period in Australia due to the coronavirus pandemic in 2020, the city saw significant impacts to their economy. PWC forecasted in September 2020 that the top 3 industries would see 38,300 in job losses and a drop of $8.86b in economic output in 2020 compared to the figures in 20198.

Despite the setbacks that COVID-19 had to their economy, the City of Melbourne acted quickly to support businesses and begin its recovery immediately.

The City’s recovery plan included these key initiatives:

These key initiatives put in place by the Melbourne Government have been selected to reactivate the city and begin building economic resilience.

Property investor guide

Our free, downloadable guide explains the costs and steps associated with the purchase of an investment property, positive/negative gearing as well as pros and cons of houses vs. units.

Melbourne Rental Yields

Rental yield is one of the most important figures to understand when investing in a property. It is essentially the amount of money you make on an investment property by measuring the gap between your overall costs and the income you receive from renting out your property.

The impact of 2020 has also affected the rental yield to both houses and units in Melbourne, with the city experiencing a 10 year low rental yield in April 2021 of 3.3% for units and 2.6% for houses9. Traditionally Melbourne’s rental market has remained relatively steady, however the effects of coronavirus and the extended lockdowns in the city have increased the vacancy rates in Melbourne to its peak in December 2020 of 4.7%10.

With the withdrawal of international students and the decline in rental accommodation in 2020, Melbourne’s rental market has taken a hit, with rental yields and asking rent decreasing while vacancies have increased. This is important to consider when looking to invest in Melbourne as despite the property market looking to recover with increases in property prices, the rental market is still seeing low numbers compared to the previous trends.

Best Suburbs in Melbourne to Invest

There are of course many suburbs in Melbourne that are great locations to begin or grow your investment portfolio. Through our analysis of the Melbourne property market, we have identified suburbs in the high, medium and low end that may be a great opportunity to begin your investment journey with. These 3 suburbs were chosen due to their proximity to the CBD, historical property growth and potential rental yields and may serve as a guide that we believe can provide strong results if you’re looking to invest in property.

How to invest in the Melbourne property market

If you’re ready to start investing in Melbourne, the next step in your journey is to speak with a broker to apply for an investment loan.

For your first investment property, we have created a beginners guide to outline the main factors you need to consider and the costs involved here.

When applying for an investment home loan, it is best to understand what type of loan is right for you and the associated rates. You can compare investment loans across multiple lenders from our panel here or speak to a Mortgage Choice Broker who can go through your situation, compare the loans available and find the loan that’s right for you.

We’re here to help

Of course, this is only a starting point, as there are many areas in Melbourne that can offer similar or greater investment opportunities. If you’re interested in investing in Melbourne and are ready to get the process started, it is best to speak with your local Mortgage Choice broker to get expert advice on your property investing journey.