WA Housing Market

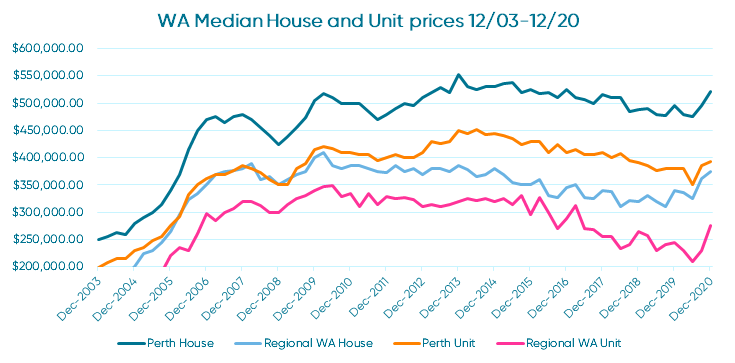

Western Australia’s property market has shown to be relatively stable over the past 10 years. Historically houses in both Perth and Regional WA have shown to maintain their value and have less fluctuation in price when compared to the prices in units. As the below graph indicates the housing market in Perth has peaked in December 2013 with a median price of $552,000.4

Source: Median price (unstratified) and number of transfers (capital city and rest of state)

Source: Median price (unstratified) and number of transfers (capital city and rest of state)

As 2020 saw housing markets across the country impacted by COVID-19, WA was no exception. In June 2020 after the initial impacts of COVID-19 affected the state, the house and unit prices across the state saw a decrease, with Perth property prices hitting their lowest median since September 2011 and regional prices hitting their lowest since September 2018.

Although the state saw declines in housing prices early on, the trend quickly shifted upward towards the end of 2020 and continuing onto 2021. Over the first three months of 2021, CoreLogic has reported that Perth’s home value index has grown 5% - their fastest rate in 30 years.5 This strong performance to start the year has led REIWA to forecast WA’s housing market to continue this growth as the state is expected to grow by 15% this year.6 As WA’s housing market is expected to see strong performance this year, now is a great time to look at investing in property in WA.