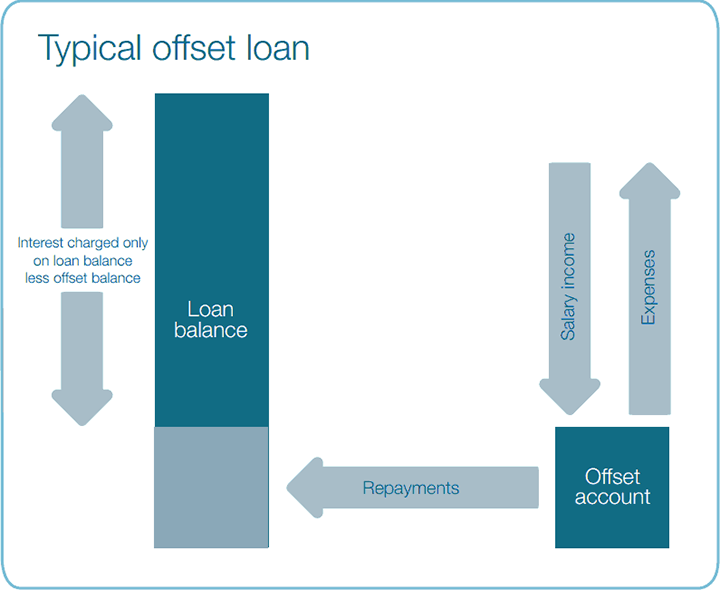

Many lenders offer a 100% offset account as a feature with standard variable home loans.

You can deposit your income into this transaction account and use it for day-to-day expenses. Any money in this account is offset against the amount owing on the home loan, and interest payable on the mortgage is then calculated on the loan balance less funds held in the offset account, reducing the amount of interest paid on your loan.