Fixed home loan interest rates

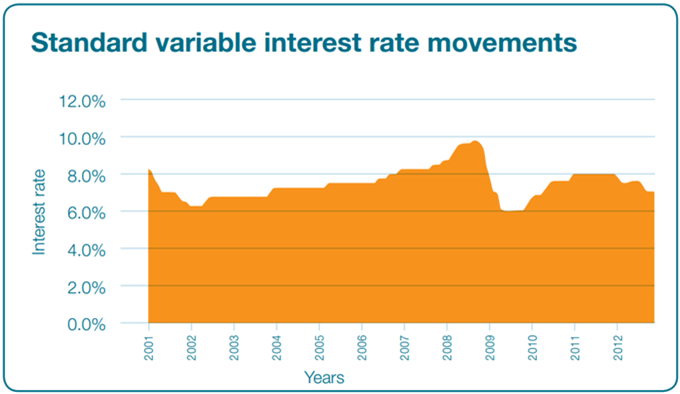

Fixed home loan interest rates could be termed predictive. That is, lenders look at the cost of holding money at a certain rate for a certain amount of time, and determine the interest rate accordingly.

In general, if a lender expects the cash rate to rise, the fixed rate will usually be higher than the variable rate; on the other hand, if the expectation is for the cash rate to fall, the fixed rate will tend to be lower than the current variable rate.

When a borrower fixes the interest rate on their home loan, they are usually anticipating that the variable rate will rise above the rates which they have locked in.

Lenders may offer fixed terms between 1 and 10 years; however, most fixed rate terms are between one and five years.

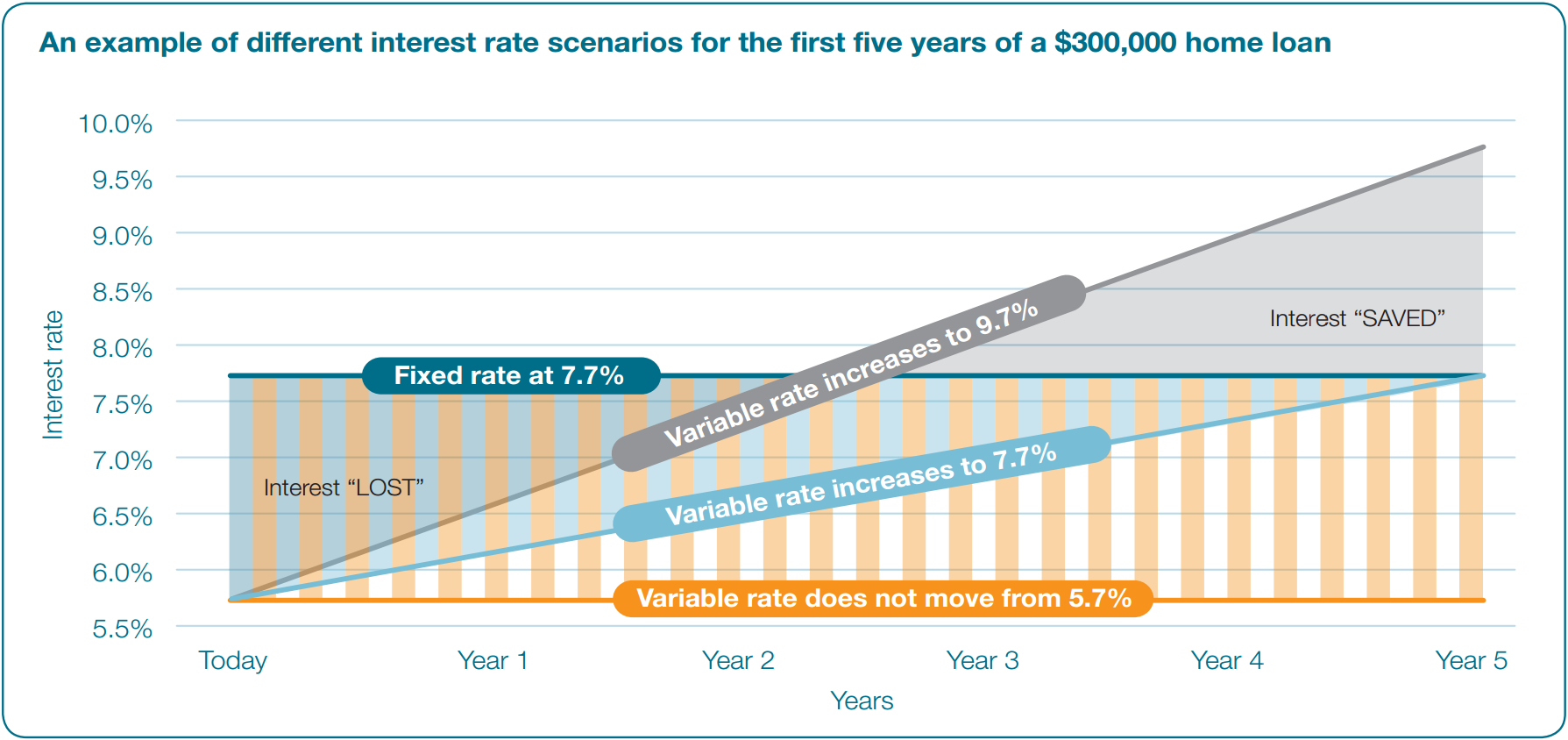

Once a borrower has locked in their fixed rate, they will start paying the fixed interest rate straight away.

For example, if a borrower fixed their loan today at a five-year fixed rate which is 2% higher than the variable rate, the borrower would start paying an extra 2% interest right away.

Pros and cons of fixed rates

A fixed rate loan is a loan that has a fixed interest rate and therefore fixed loan repayments.

The time period of these loans can vary, but you can usually "lock in" your repayments for between 1-5 years. Although the fixed rate period may be 3 years, the total length of the loan itself may be 25 or 30 years. At the end of the fixed loan period you can decide whether to fix the loan again for another period of time at the current market rates or convert the loan to a variable interest rate for the remaining time left of the loan.

Pros:

- Repayments do not rise if the official interest rate rises

- Provides peace of mind for borrowers concerned about rate rises

- Allows more precise budgeting

Cons:

- Repayments do not fall if rates fall

- Allows only limited additional payments

- Penalises early payout of the loan