Steve Chin - Your Local Home Loan Expert

.png)

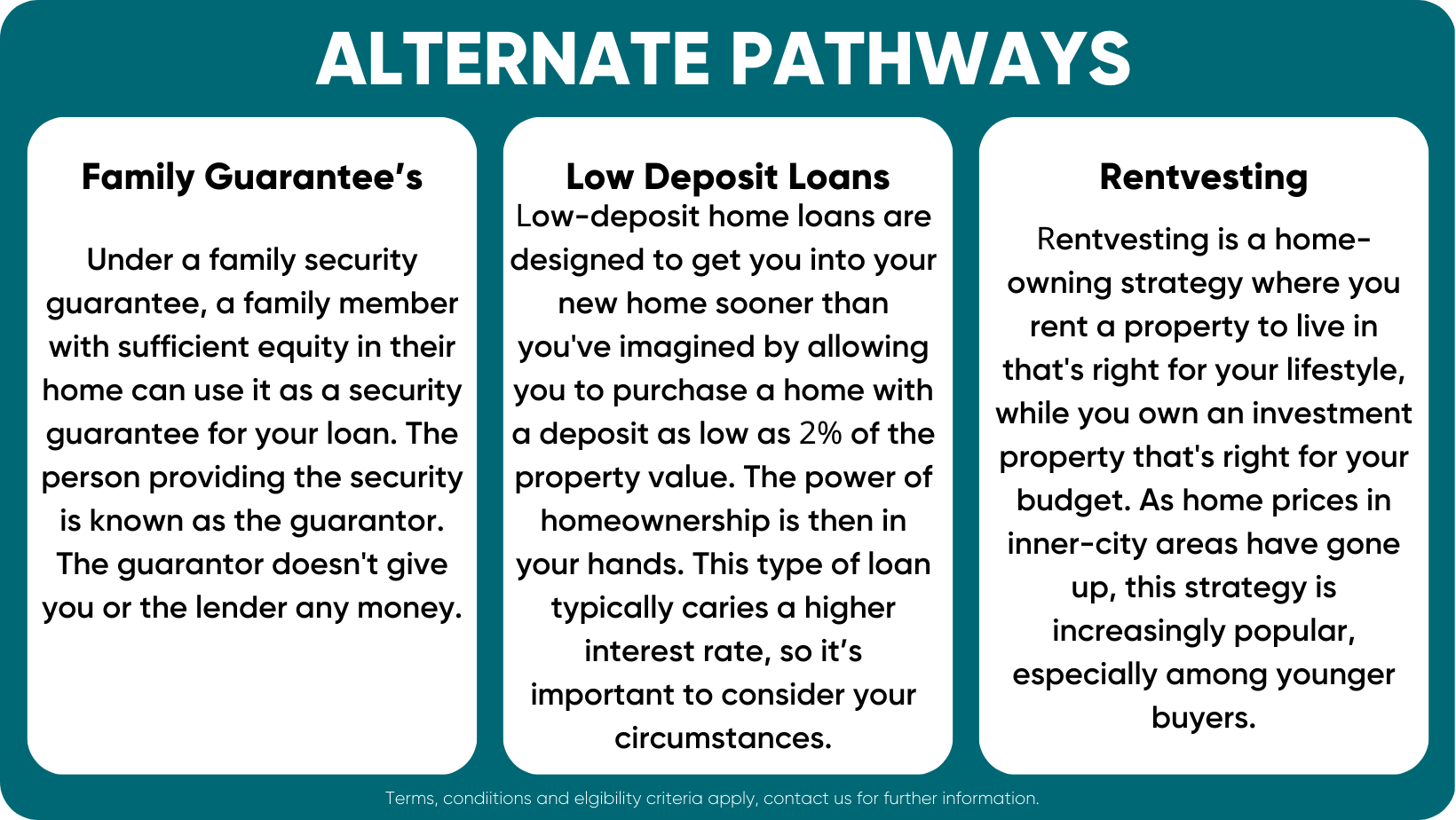

Embarking on the path to becoming a first-time homebuyer is a significant achievement, signifying a substantial financial commitment. While the process of acquiring a home may seem daunting, it can also be an enriching and seamless journey when armed with the correct information and support. Purchasing your first home involves various considerations, spanning from financial planning and saving to selecting the ideal location and property type.

Having access to valuable tips and guidance becomes crucial for those venturing into homeownership for the first time. Our objective is to furnish you with the essential knowledge and resources needed to make well-informed decisions throughout every phase of your homeownership journey, ensuring you approach this crucial step with confidence and preparedness.

.png)

First home buyer's guide

Purchasing your first property can be an overwhelming process and there may be steps you are unsure or unaware aware of. This guide will walk you through all of the steps involved in the buying process.

.png)

.png)

.png)

The appointment process

.png)

.png)

Ready to talk to someone?

With over 65+ 5-star Google reviews from our lovely clients, check out what our clients say about our award-winning service. Our experienced and dedicated team are here to guide you through the process so contact us to get started today!

Book an appointment Call: 08 8270 5138 What to expect at your appointment

.png)

First Home Buyer FAQs

If you're ready to buy your first home you may be wondering what government help is avaible.

In this video we explain the different Government Grants and incentives available to first home buyers, including the First Home Owner Grant, Stamp Duty Concessions and the First Home Loan Deposit Scheme.