Seeing a mortgage broker? Here's what happens

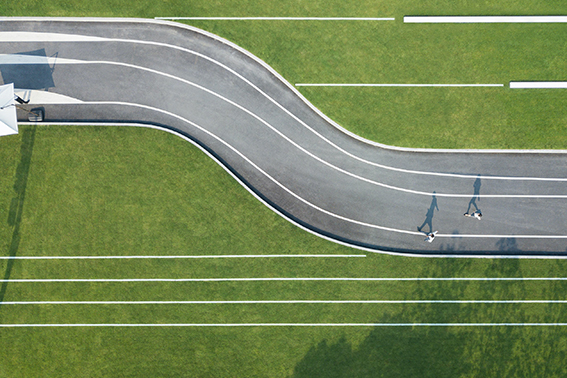

Our journey together

Mortgage Choice Williamstown is committed to provide accessible, clear and holistic advice to build long-term relationships beyond the loan process to empower better life choices for our clients.

That's why our appointment process is designed to discover more about you from the very beginning.

We work with you to answer questions like...

- What's the process of buying, and what's the best way to get started?

- What government grants and initiatives can I take advantage of?

- Is the First Home Loan Deposit Scheme (FHLDS) or First Home Owner Grant (FHOG) for me?

- What is the most effective loan structure to maximise return on investment?

- How can I use the existing equity in my home to purchase an investment?

- How much can I borrow, what will my repayments be and how do I future proof my finances?

By leaving no stone unturned, we can impart tailored and accurate advice to help you achieve a solid financial foundation to build wealth on.

The appointment process

Your Appointment FAQs

Ready to get started?

Our role is to guide our clients through the complex and often confusing financial space. We care enough to share accessible, clear and holistic advice and we strive to build long-term relationships beyond the loan process to empower better life choices for our clients.

Leverage our expert knowledge to build your foundation of wealth today for tomorrow.

Call: 03 9397 0365 Meet your Team