Our award-winning Mortgage Broker team in Camberwell, Canterbury, Glen Iris, Hawthorn & Surrounds

Canterbury

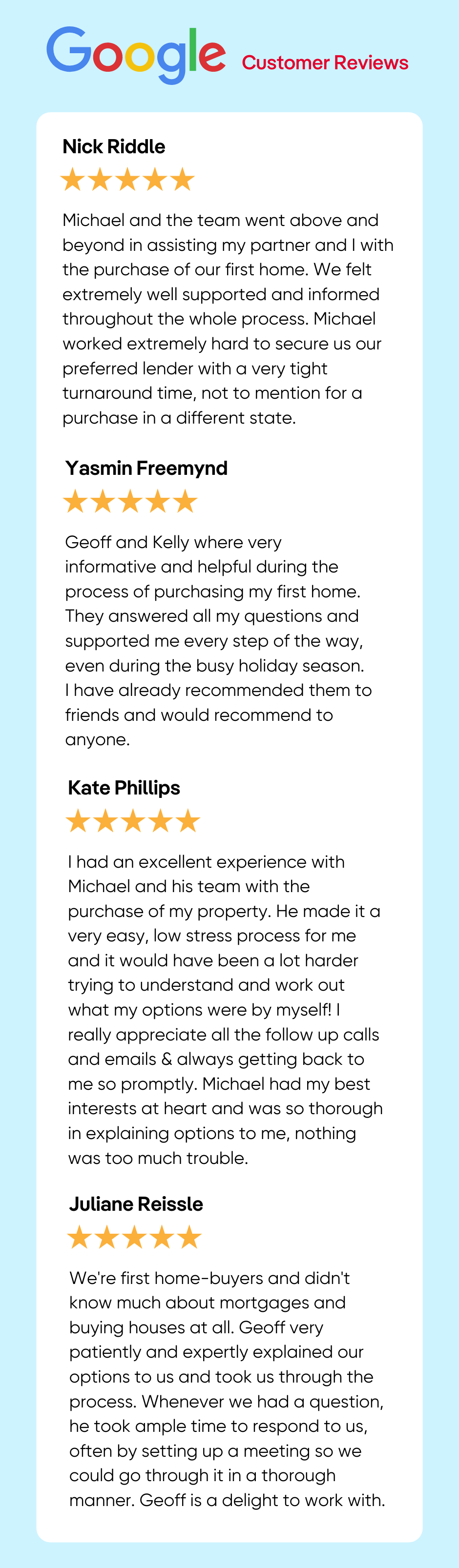

5.0

(206+ total reviews)

Aggregated from:

![]()

![]()

![]()

![]()

![]()

- Call Us

- Office - 03 9813 3522

- Fax - 03 9813 3544

- Open Hours

- 8:30am - 6pm Monday to Friday - After hours by appointment

59 Canterbury Road CANTERBURY, VIC 3126

Start your home loan journey today

Welcome to Mortgage Choice in Camberwell & Canterbury

Mortgage Choice in Camberwell & Canterbury has been helping the local community with their home loans & finances for over 15 years. Our team of mortgage brokers & home loan experts specialise in helping people find the right home loan with the features and benefits they need.

Our free home loan service

Finding a home loan with the right features at the right rate, can be daunting. Our free home loan service means that we'll do all the work for you, and make the process as easy as possible. We do all the research and negotiate with your lender to get you the best deal.

- We do the research for you from over 35 lenders;

- We do all the paperwork and put together your application;

- We negotiate with the banks & do the follow-up on your behalf;

- We talk you through each step of the process to settlement.

- We review your loan when it's time to see if you could save.

We have over 35 lenders on our panel

We all know that a wide range is the key to finding the right deal - and the same is true for your home loan! At Mortgage Choice in Camberwell & Canterbury, we have over 35 lenders on our panel, giving you access to thousands of home loans at once.

We don't just let any lender on our panel either. They have to be the best at what they do and have a great range of home loan products and rates available for our clients.

Get started with us today

Helping people with their home loans is what we love to do! Contact our team at Mortgage Choice in Camberwell & Canterbury to chat about your next move via phone, video or in person at our office located at 57 Canterbury Rd, Canterbury 3126 .

Call 03 9813 3522 Request a call

The Mortgage Broker Camberwell team service the areas of Camberwell, Canterbury, Glen Iris, Balwyn, Hawthorn, Richmond, Deepdene, Mont Albert, Surrey Hills & surrounding Melbourne.

Read more reviews for our team

Check your borrowing capacity

Are you eager to understand your borrowing capacity based on your salary and financial commitments? At Mortgage Choice servicing Camberwell, Canterbury, Glen Iris & Hawthorn and surrounds we understand that finding out how much you can borrow for that dream home you’ve always wanted can be tricky, which is why we have some awesome calculators to make it easy!

Check out our free home loan calculators here free home loan calculators here or get in touch with us to discuss your unique circumstances.

The right home loan for your needs

Our mission is to find the right home loan for your individual needs and to always have your best interests at heart. Plain and simple. Which is why we have such a wide range of lenders to choose from. We can search through hundreds of products to find something tailored to your situation. ~

Refinancing guide

Considering refinancing? Our guide explains the reasons, costs and steps involved in refinancing your home loan.