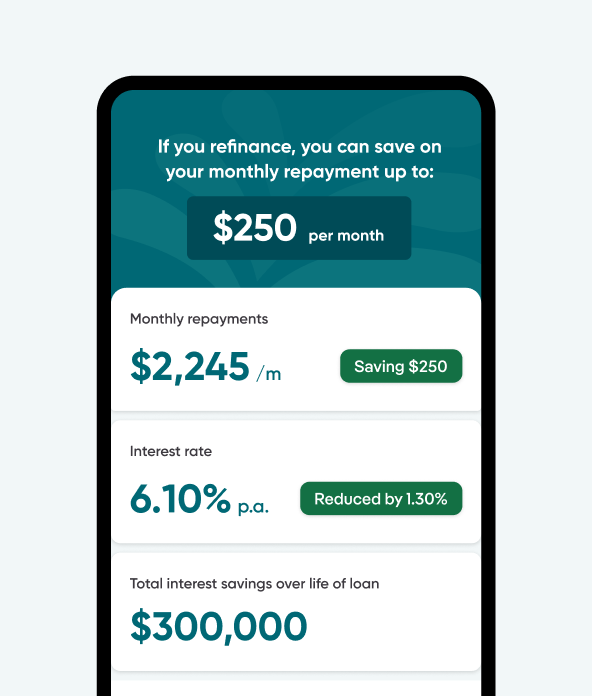

Refinancing? Find out how much you could save in 3 minutes

What you will get:

Compare your existing loan against thousands of home loan options.

Find out how much you could save on your repayments.

No impact to your credit score.

No commitment until you are ready

What you will need

3 minutes of your time.

Your current loan details.

Income, living expenses and other basic information, these can be rough estimations.

How we protect your information

We respect and protect your privacy and take every reasonable measure to protect your personal information. Find out more in our Privacy Policy and Consumer Protection policies.