Self Managed Super Funds (SMSF) Lending and refinance - Henley, Grange, Tennyson

SMSF Loan | SMSF Borrowing | Limited Recourse Borrowing | SMSF Loans | SMSF rules on borrowings

To arrange an appointment please call Craig on 0407 973 685 or Email Craig:

In essence, SMSFs work similarly to other funds that help borrowers save for retirement. The difference, however, is that members of an SMSF (usually up to six) are also the trustees and are ultimately responsible for complying with super and tax laws.

What is an SMSF loan?

An SMSF loan refers to financing that allows SMSF to invest, providing an opportunity for the fund to buy larger value assets.

SMSF loans are typically used to fund residential and commercial property purchases, which are used to help grow the members’ retirement savings.

It is crucial to take note, however, that any property financed through an SMSF loan must not be used for the benefit of a fund member — this means that the property cannot be lived in or rented out to a member or any related parties.

SMSF loans cannot also be used to acquire assets from a member.

However, an exception to the rule is when the financing is used to invest in commercial property — this can be leased to a fund member for their business provided that the lease follows the current market rate.

How does an SMSF loan work?

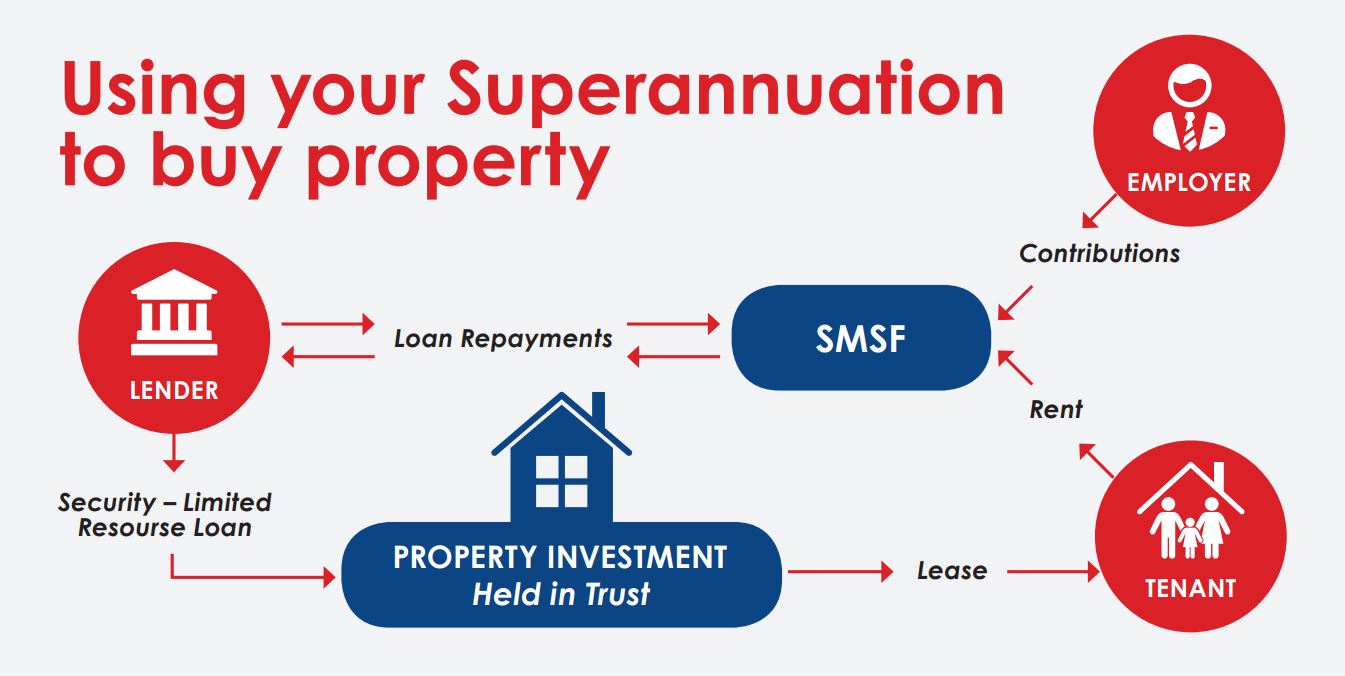

A legal SMSF loan is in a limited recourse borrowing arrangement or LRBA.

Any investment returns earned from the asset go to the SMSF trustee.

In the event that the loan defaults, the lender’s rights will be limited to the asset held in the separate trust — this means that the other assets held within the SMSF will not be affected, only the one in which the loan is secured against.

Download our SMSF Fact Sheet here:

Which lenders offer SMSF loans?

Not all lenders offer SMSF loans — those that do can charge higher interest for SMSF loans than for regular home loans, since they are designed for the purchase of an investment commercial or residential property. Talk to our team to understand which Mortgage Choice selected lenders offer well-priced SMSF Loans and how we can structure and fund a competitively priced SMSF Loan for you.

To arrange an appointment please call Craig on 0407 973 685 or Email Craig:

Do you need to refinance an SMSF loan?

We can offer SMSF loans at very competitive rates and fee structures. if you have not reviewed your Self Manager Super Fund Loan recently, we would strongly recommend you contact us !!!

To learn more:

please call Craig

on 0407 973 685 or Email Craig:

If you would like Craig to organise a free loan health check for your SMSF Loans, just get in touch this week - Mobile: 0407 973 685 or Email Craig:

The Australian Tax Office has some great tips on setting up and investing in a Self Managed Super Fund. Please check out these ATO Links:

Thinking about a Self Managed Super Fund?

Setting up a Self Managed Super Fund?

Learn more about "Is buying in your SMSF is right for you?"

Craig Pitman can also help you with

Home Loan Refinance Specialist

Henley Beach, Grange, West Beach, Fulham - Specialist

West Lakes, Semaphore, Tennyson - Specialist

Property Investment Lending Specialist