November 01, 2018

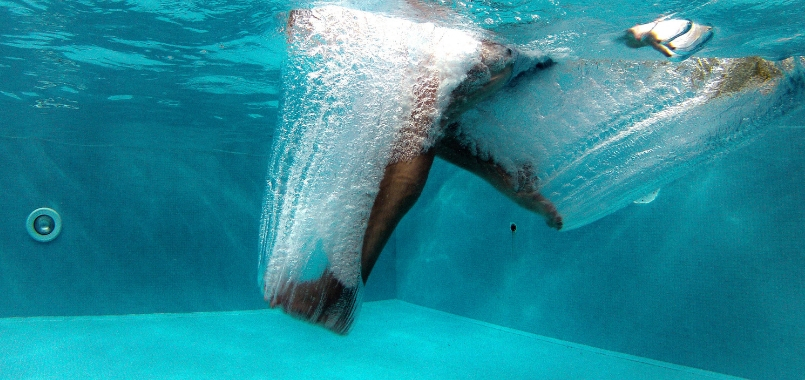

If you’ve ever experienced ‘pool envy’, you’ll know what it means to really want a pool to call your own. The temperatures are set to soar again around Broadbeach, Mermaid Beach and other parts of the Gold Coast this summer. So if you’ve been gazing into your pool-free yard and dreaming of diving into crystal-clear water in the comfort of your own home - it may be more accessible than you think.

Lots of Gold Coast families and couples know the joys of having their own swimming pool – plenty of Broadbeach and southern Gold Coast area properties are lucky enough to have them.

But if you’re thinking of having a pool installed then you’re in a great position – you have the luxury of selecting and designing the pool of your dreams. Your mortgage broker team in Broadbeach has the experience, contacts and access to finance to make it work for you.

So what do you really need to know if you’re seriously considering getting a pool installed ready for summer? Mortgage Choice at Pacific Fair’s mortgage brokers have broken down the details for you here.

Options you have for financing a pool

There are a few options that you have access to when looking to finance a pool. Lending for ‘bigger ticket items’ like pools, works in similar ways to normal personal loans or home loans for renovations. In either case, you have a few options that your Broadbeach mortgage broker team can take you through.

Using a personal loan to fund a pool

When it comes to personal loans for financing a pool, there are two types you could consider – secured or unsecured.

Secured personal loans use an existing asset that you have like a car or your home to secure the finance. If you have some equity built up in your home you could use the equity as security. These types of loans are less risky for lenders so you can often access lower interest rates and fees with them.

Unsecured personal loans don’t require you to secure the loan with an existing asset. While this type of loan may be less risky for you as you don’t need to attach a significant asset to it, lenders see these loans as posing more risk to them, and can charge higher fees and interest rates for unsecured loans.

Using your equity to finance a pool

Accessing equity that you’ve built up in your existing property is a great way of using your home loan to access the pool you’ve been dreaming of. You could take out a home equity loan, which allows you to borrow money using your home equity as collateral.

The advantage of using your equity to fund a pool installation is that you’ll be keeping all of your debts in one place and not have to pay fees on, or manage a separate loan.

This could also be a perfect opportunity to see if you can refinance your current home loan to a lower interest rate, and potentially save money in the long run by lowering repayments or reducing the life of your home loan – even by financing a pool!

Now is the perfect time to speak to your mortgage brokers in Broadbeach about whether financing for a pool could be much more affordable than you think – especially if you haven’t reviewed your mortgage interest rate for a few years.

Common costs involved in getting a pool

While it would be great to click your fingers once the finance is sorted and see your pool appear before your eyes, this is a bit unrealistic. There’s a process involved in any home renovation and a few of the costs involved in having a pool are worth knowing up-front.

Home insurance when you have a pool

Have a chat with your Broadbeach mortgage brokers about home insurance, as this sometimes can increase when a property has a pool. Our team has access to some competitive Insurers and can help you navigate this process.

Unexpected installation issues

Before and during the installation of your pool, you’ll want to be as aware as possible about water lines and other underground obstructions. Large rocks or other unexpected objects can sometimes increase installation costs. However if you select an experienced pool building company, like L&V Pools, recommended by Mortgage Choice at Pacific Fair, then you’ll know you’re getting the best possible guidance on any potential issues with your installation.

Ongoing pool maintenance

Something else that our preferred pool partner L&V Pools can help you with is the ongoing maintenance. Whether you’re happy to manage it yourself, or you’d rather pay the professionals, there is an amount of time that you will be required to dedicate to your new outdoor addition, and associated costs that you should be aware of.

Choosing what pool will work for your needs

The most fun of having a pool installed in your backyard, other than jumping in when it’s done, would have to be deciding on the design. Here are a few tips that you might want to think about as your pool starts to become a reality:

- Pool size and shape – generally dependant on the space you have to work with, but you should also consider what landscaping or entertainment space you want to leave pool-free and what shape of pool will work best to accommodate what you want to achieve.

- In-ground or above-ground – above-ground pools tend to be less costly to install, however they don’t often have the same quality look or add as much potential value to your property as an in-ground pool.

- Pool depth – one depth or graded depth? If kids will be using the pool then how shallow do you go? And will you need a decent depth for a slide or diving board? Other features like ‘tanning ledges’ or ‘swim out shelves’ are popular and can give you shallow areas for everyone to cool off in.

- Material and finishes – Whether you choose concrete, vinyl or fibreglass and opt for a whole range of finishes, L&V Pools or another experienced pool builder should be your go-to for deciding between cost, longevity and look.

Will a pool add value to my home?

When considering the installation of something as substantial as a pool, you want to know that there could be some benefit down the track if you eventually sell your home. While many property experts will say that pools can be hit and miss, there are factors that can make pools more hit than a miss.

Purchasing on the Gold Coast in a holiday area like Broadbeach, Mermaid Beach or the surrounding Mermaid Waters area as many of our clients do, generally appeals to a certain type of person. We often see buyers who are sea-changers and looking for the true Gold Coast lifestyle, which more often than not includes having a pool.

Knowing your target market, even if you’re not interested in selling your home now, is worth it if you’re going to drop a fair chunk of change on a home reno. In this area of the Gold Coast it’s safe to say that many buyers feel like a pool is part of the expectation and can be a worthwhile investment.

Broadbeach mortgage broker team – helping you finance your dream pool

Let our team at Mortgage Choice at Pacific Fair, Broadbeach take you through your pool finance options. Our home and personal loan service is always at no obligation and free of charge.

Our team also has access to contacts in the pool building industry that we can vouch for, and once the finance is sorted you can get on with the exciting process of building your ideal pool in time for summer.

Contact your Broadbeach mortgage broker team for a no-obligation appointment to discuss your options. Call 07 5676 6433 or click ‘Contact us’ and we’ll get the details we need to contact you.