Maximizing the Benefits of an Offset Account

Maximizing the Benefits of an Offset Account

One of the most significant financial commitments you'll undertake in your lifetime is securing a home loan. However, there is a way to reduce the overall cost, specifically the interest payments, and shorten the loan duration. This method is through the use of an offset account, a financial tool that, when used correctly, can save you thousands of dollars.

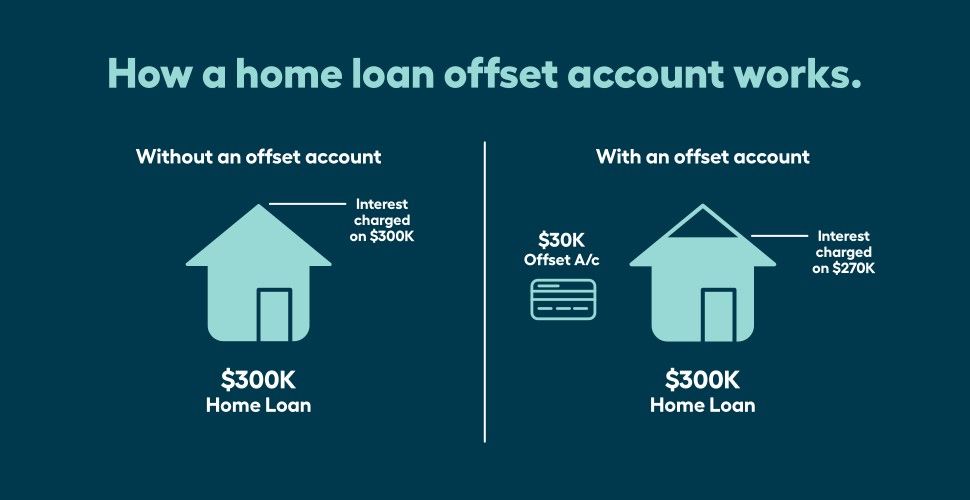

The concept behind an offset account is straightforward. It is essentially a transaction or everyday banking account linked to your home loan. The funds you maintain in this account "offset" the balance of your loan, thereby decreasing the interest you pay each month. Over time, these savings accumulate, enabling you to expedite the repayment of your loan.

It's essential to note that many home loans in Australia offer an offset account, but it is typically available only with variable rate home loans.

To learn more, please contact Alex on 0475 461904 or email alex.fyfe@mortgagechoice.com.au

How does an offset account function? Let's consider an example. If you have a home loan of $400,000 with an interest rate of 6% and maintain $20,000 in your offset account, you will only be paying interest on the reduced amount of $380,000. Over the course of a 30-year loan, this can result in savings of more than $87,000 in interest, allowing you to shorten the loan duration by more than three years—all because you've maintained that extra $20,000 in the appropriate account.

You may wonder what happens if you need to access the $20,000 for an emergency. The beauty of an offset account is that it functions much like a regular banking account, granting you access to your additional funds at any time, though it may affect the amount of interest you save if you do so.

To make the most of your offset account, consider these three strategies:

1. Direct Your Savings into the Offset Account: Any windfalls or lump sum amounts, such as an inheritance or funds in a term deposit, can be more effectively utilized in an offset account. While it may seem counterintuitive if you're accustomed to locking away your savings in a high-interest account, it makes sense because your home loan interest rate is typically higher than the rate on your savings account. Additionally, by putting your extra funds in the offset account, you can avoid paying income tax on the interest earned, maximizing your savings.

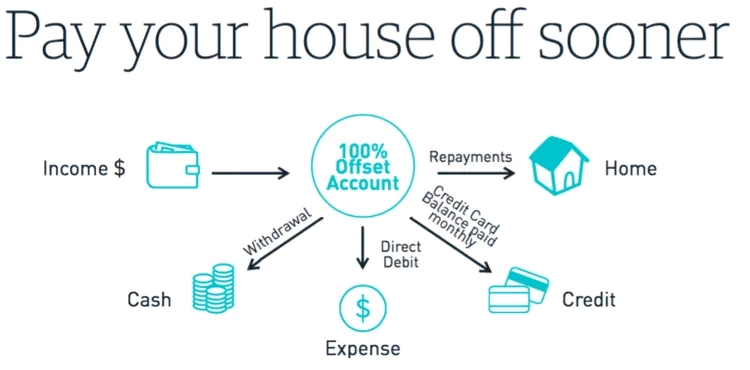

2. Deposit Your Salary into the Offset Account: If your offset account offers a debit card and online payment access, consider making it your primary transaction account and direct your employer to deposit your salary there. Since interest is calculated daily in an offset account, you will benefit even if the balance fluctuates with daily transactions.

3. Combine Your Offset Account with Credit Card Payments: By maintaining more money in your offset account for longer periods, you can achieve greater savings. To implement this strategy, use a credit card for everyday expenses and take advantage of the interest-free payment period. It's crucial to pay off the full balance when it's due, as credit card interest is typically higher than home loan interest.

The Benefits of an Offset Account Include:

Reduced interest payments over the life of your loan.

Convenient fund transfers and online payments.

Access to a debit card for ATM withdrawals and store payments.

When considering an offset account, pay attention to the following factors:

Opt for a 100% (full) offset account rather than a partial offset.

Ensure easy access to your offset funds.

Check for any balance limits or withdrawal penalties.

It's worth noting that some banks offer multiple offset accounts linked to a single loan, which can be helpful if you're saving for various major expenses, such as another property, a vacation, a wedding, or a new car.

To learn more, please contact Alex on 0475 461904 or email alex.fyfe@mortgagechoice.com.au

Finally, it's essential to distinguish between an offset account and a redraw facility. While both can help reduce interest on your variable home loan through extra repayments, they have their differences. A redraw facility may not provide immediate access to your savings, but it increases your equity in the home by paying off the principal. Many home loans offer both options, so the key to saving as much as possible on your home loan is to use them effectively.

To learn more, please contact Alex on 0475 461904 or email alex.fyfe@mortgagechoice.com.au

Alex can also help you with:

A Home Loan Broker who cares for the community

First Home Buyer - Loan Specialist

Refinancing your existing Home

Mortgage Broker - Port Augusta Whyalla Port Pirie

Self Managed Super Fund (SMSF) Lending

Small Business & Commercial Lending Specialist

Proud Sponsor of the Norwood Football Club - Redlegs