Is now the time to invest in property?

Finance for property investors rose 4.2% in February 2022. It caps off a 12-month period that saw a 56% increase in loans to investors1. But how is the market shaping up for those wanting to invest?

It seems a growing number of Australians are getting into the property market as investors. Data from the Australian Bureau of Statistics confirms that loans to investors climbed 4.2% in February 2022 – with a total of $10.7 billion extended to investors during the month, compared to $6.9 billion in February 20212.

According to the newly launched PropTrack Home Price Index Report for March 20223, the return of investors is something we can expect to continue in 2022. And several factors are behind this.

Price growth is cooling

Ramped up investor activity is occurring at a time when housing price growth has slowed. PropTrack says prices rose by just 0.34% nationally in March 2022 – the slowest monthly pace since May 2020.

However, as PropTrack notes, 2021 was such an exceptional year for home price growth – the third fastest episode in Australia's history. It would take further exceptional circumstances to match that in 2022.

For investors concerned about the ‘heat’ we saw in the property market last year, it can be reassuring to know price growth is starting to ease.

Regional areas still more affordable

Regional areas continue to benefit from relative affordability as well as the preference for lifestyle locations that we’ve seen through the COVID-19 pandemic.

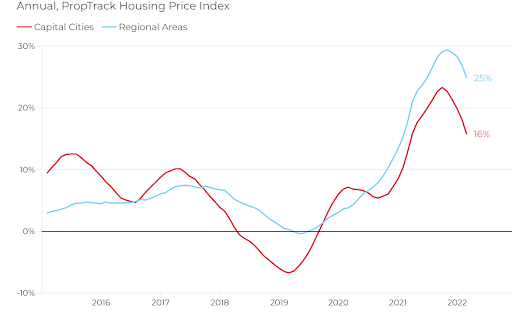

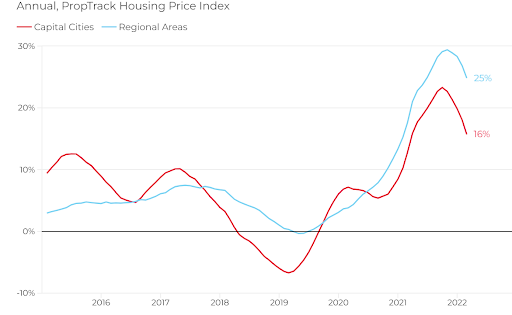

According to PropTrack, this has pushed up regional property prices by 25% over the past year compared to 16% across the state capitals. This growth gap is expected to continue, at least for the first half of 2022.

Housing price growth

Source: PropTrack Home Price Index Report for March 2022

Planning to invest? Get your free home loan quote today.

Get startedImmigration could be the game changer

While the lure of regional Australia remains strong, PropTrack believes this attraction may wane as 2022 (hopefully) marks a year of fewer COVID-related interruptions, and we see a return of higher denser living.

It’s on the score of denser living that investors could have opportunities at present.

As border restrictions and quarantine arrangements are relaxed, net overseas migration is forecast to make a recovery.

The Federal Government expects the net inflow from immigration to reach 180,000 people in 2022-23, followed by 213,000 in 2023-24. After that, net immigration is expected to return to its pre-COVID inflows of 235,000 arrivals annually from 2024-254. That’s a lot of people looking for homes to live in.

As PropTrack points out, the return of immigration will revive a key source of rental demand for landlords, particularly in inner-city regions.

Even better, preference shifts since the start of the pandemic have made inner city locations and apartments relatively cheap – and these are the types of properties investors often prefer.

Already, SQM Research5 says the national residential vacancy rates fell to 1.2% in February 2022 – a 16-year low. The number of available rental properties has plunged in the Melbourne and Sydney CBDs, and capital city asking rents have soared 9.4% over the year to mid-March 2022. For investors, the combination of tighter vacancies and rising rents can be very appealing.

The verdict

As PropTrack explains, the outlook for property price growth remains subdued. But as seasoned investors will know, property can deliver its best capital growth over the long term. In the meantime, a rental property has the potential to deliver regular rent returns, often with tax savings through negative gearing.

If a rental property is on your wish list, talk to your Mortgage Choice broker to understand your borrowing power, and start the ball rolling on the investment loan that’s right for you.

1 https://www.abs.gov.au/statistics/economy/finance/lending-indicators/latest-release

2 https://www.abs.gov.au/statistics/economy/finance/lending-indicators/latest-release

3 https://www.realestate.com.au/insights/proptrack-home-price-index-march-2022/

4 https://population.gov.au/sites/population.gov.au/files/2021-12/population_statement_2021.pdf

5 https://sqmresearch.com.au/15_03_22_National-Vacancy-Rate-Falls-In-February-2022_SQM-Research_FINAL.pdf