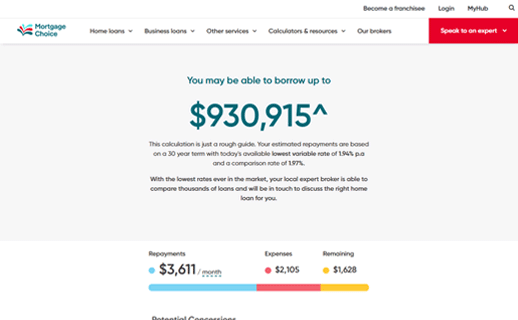

Know your borrowing power in less than 5 minutes.

Have your income and expenses information handy.

Don’t stress if you don't have the exact numbers, estimates are fine.

We respect and protect your privacy and take every reasonable measure to protect your personal information. Find out more in our Privacy Policy and Consumer Protection policies and see product warnings below.