The time for completion can be set by agreement between the parties.

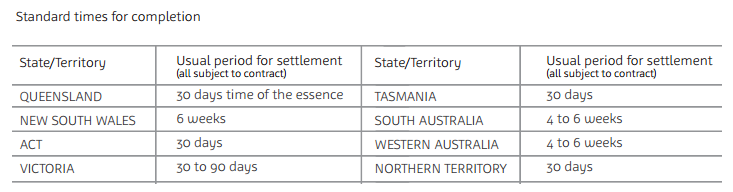

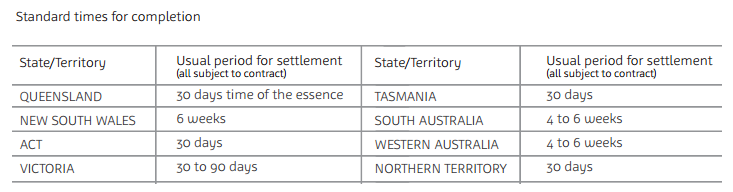

The time span for completion of “off the plan” purchases can be quite lengthy. This is because the contract can be completed only after the development/building construction has completed and new titles are issued. The standard times for completion are set out in the table below, but these periods can be changed by agreement between the vendor and the purchaser.

What is “time of the essence”?

Time is said to be of the essence of a contract if the contract specifically says so. This means failure by either party to complete on a nominated date is a “breach of a fundamental term”. If there is a breach of a fundamental term, the other party can terminate the contract, forfeit and keep the deposit (in the case of a breach by the purchaser), and sue for damages.

Example: A real estate contract provides for completion “within 42 days of exchange, time of the essence”. If the purchaser does not complete on or before that date, the vendor can terminate the contract, forfeit the deposit, and sue for damages.

Only in Queensland is time normally of the essence, although time can be expressed to be of the essence in any State or Territory.

Contracts that are not time of the essence frequently contain a provision entitling the vendor to give the purchaser a notice (usually 14 days) making time of the essence for completion at the end of the 14 day period.

Example: A real estate contract provides for completion within 42 days of exchange, not time of the essence. If the purchaser does not complete on or before that date, the vendor can issue a notice to complete to the purchaser making time of the essence for the end of the notice period.