Investing in the New South Wales property market can have many benefits, depending on what your goals are. As NSW is a large state with many different regions and lifestyles, it is likely that an area is right for your investment journey.

Property Investment NSW Update 2022

New South Wales Housing Market

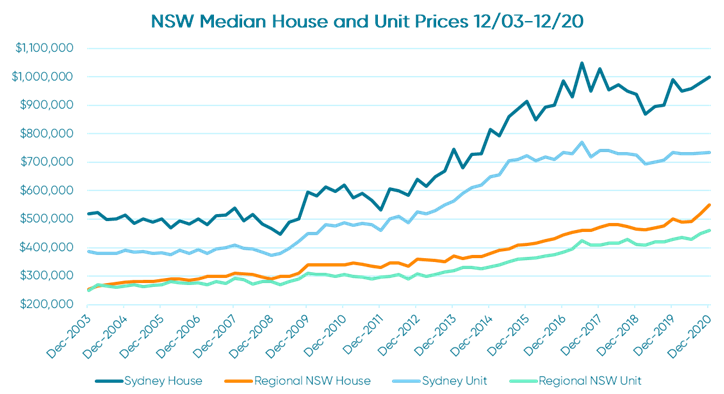

Having Sydney as its capital city, it's no surprise that NSW has the most expensive housing market in Australia. Although the market saw a decline through 2020, Sydney’s housing prices ended the year with a median house price of $1 million in December 2020.3 Despite a decrease in Sydney’s house and unit prices throughout 2020, due to the coronavirus pandemic, these resilient markets have ended the year with a 1% increase for houses and no change for units compared to December 2019.

Source: Median price (unstratified) and number of transfers (capital city and rest of state)

While Sydney’s housing market saw some downwards trends before it’s recovery in late 2020, Regional NSW performed strongly throughout the year with 10.2% and 6.9% increase in houses and units, respectively.4 These booms in the regional market can be attributed to coronavirus’ impact on the capital cities causing a trend towards regional migration for remote working and having a more affordable and spacious lifestyle.

Planning to invest? Get your free home loan quote today.

Get startedNew South Wales Economy and Infrastructure

Making up approximately a third of Australia’s economic output, NSW is the largest state economy in the country. Similar to other states in the country - and all over the world - NSW experienced significant economic challenges in 2020 due to the COVID-19 pandemic.

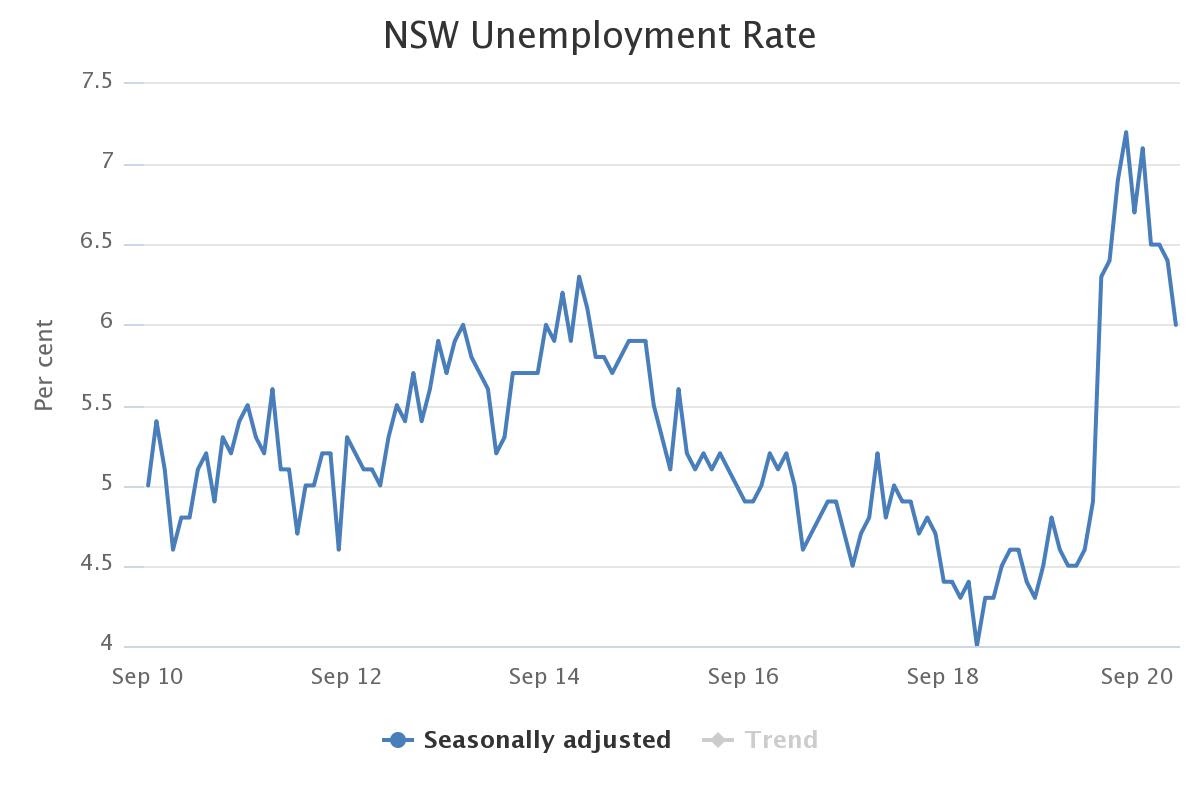

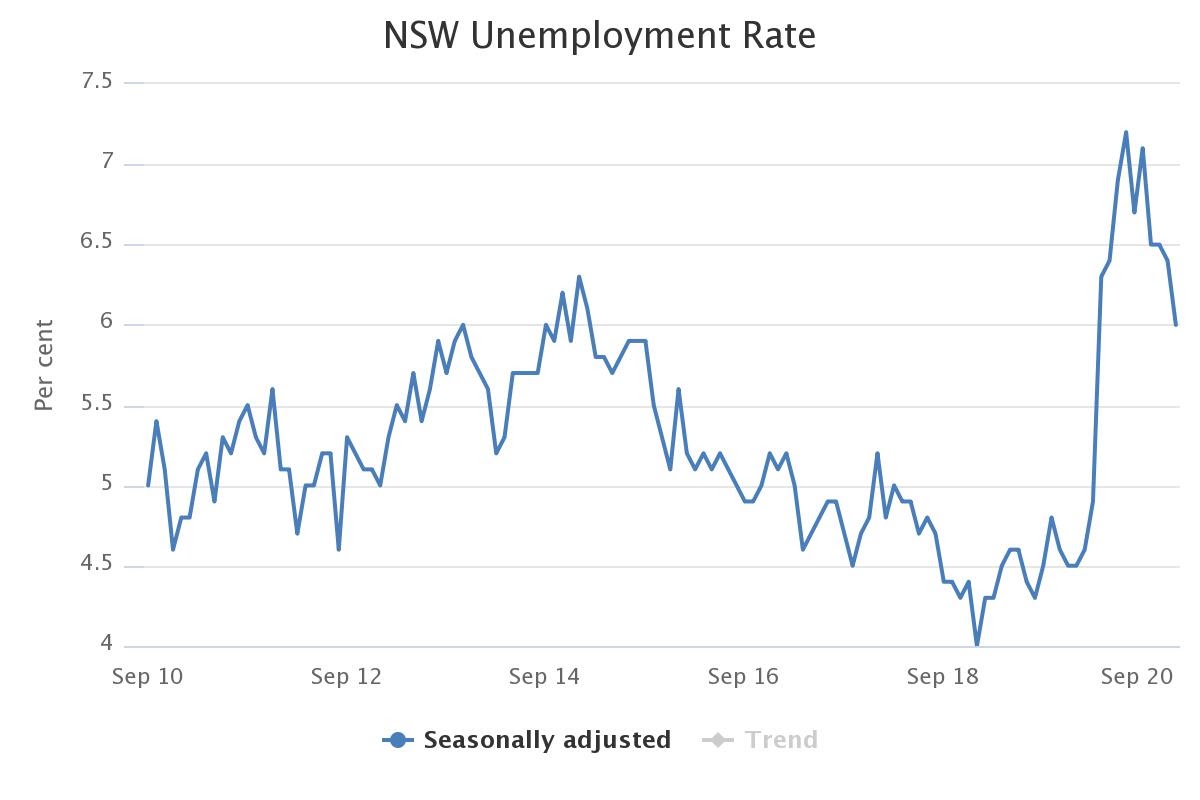

While usually experiencing high levels of growth year on year, the 2019-20FY saw the first time in recorded history that the state experienced a decreasing Gross State Product (GSP) of 0.7%.5 In addition to a decrease in GSP, NSW experienced a 10-year peak in it’s unemployment rate of 7.2% in July 2020.6

Source: https://www.treasury.nsw.gov.au/nsw-economy/nsw-economic-dashboard

Source: https://www.treasury.nsw.gov.au/nsw-economy/nsw-economic-dashboard

Despite the impacts of coronavirus on the economy in the first half of 2020, towards the end of 2020 and early 2021, NSW has begun to show promising signs of recovery. Deloitte, in their economic outlook report7, have forecasted the State will achieve economic growth of 4.4% in 2021. Another promising figure that has emerged since COVID restrictions have continued to ease can be seen in the above graph as the unemployment rate has continued to decline since its peak in July 2020. As of January 2021, this downward trend has continued as the state recorded an unemployment rate of 6%.8

A major component of NSW’s economic recovery plan as a response to the effects of COVID-19, is the commitment of $100 billion over 4 years towards their infrastructure pipeline. This allocation in their budget is expected to drive employment growth by creating 88,000 jobs and contribute to the state’s overall economic growth.9 As a direct response to the pandemic, the Government has approved 49 projects to fast-track it’s economic recovery across the state.

Key infrastructure projects include:

Property investor guide

If you are looking to invest in property or simply exploring the possibilities, this guide will help you navigate the steps involved to kickstart your property investment journey.

Best Cities in New South Wales to Invest:

New South Wales Investment Property Taxes

When buying an investment property in New South Wales there are some tax considerations that you will need to consider. In New South Wales, you will need to pay transfer (stamp) duty, within 3 months of signing a contract for sale or transfer, on any property that you purchase. You can use our handy calculator to understand more about stamp duty and how much you may need to pay here.

When owning an investment property in New South Wales, you may also need to pay land tax on the property. Land tax is payable if the total value of all your taxable land is above the land tax threshold. The threshold is updated every year and applies to land holdings you own on 31 December each year. You can find the full list of land tax thresholds on the State Revenue’s website here to understand what land tax may be applicable to you.

We are here to help

If you’re looking to purchase an investment property and you think New South Wales is the right market for you, speak to your local Mortgage Choice broker to understand what you can afford and what location may be right for you.