Sydney Housing Market

When investing in property, an understanding of a location's housing market in relation to current and previous trends can be beneficial. Sydney’s property market is widely known as being the most expensive city in Australia.

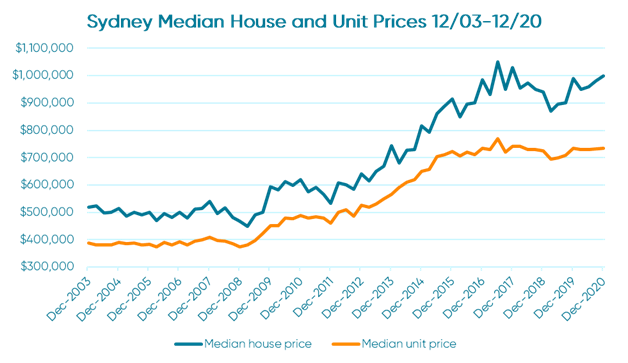

As shown below the median house and unit prices in Sydney have historically seen impressive amounts of long term growth. From December 2003 to 2020 the median house and unit prices in Sydney have increased from $520,000 and $387,000 to $1,000,000 and $735,000, respectively.3 Historically Sydney has shown it’s housing market can provide great capital growth when looking to purchase a property as a long term investment.

Source: Median price (unstratified) and number of transfers (capital city and rest of state)

Source: Median price (unstratified) and number of transfers (capital city and rest of state)

Throughout the uncertainty of 2020, Sydney’s property market saw a slight decline throughout the year. However, the resilience of this property market resulted in a quick recovery towards the end of 2020, as the housing prices in December 2020 were up 1% compared to December 2019 and Unit prices stayed flat year on year. 2021 has seen an even greater recovery in Sydney’s market with a 2.39% increase in April alone.4

Following on from the already impressive performance Sydney’s property market has experienced so far in 2021, ANZ is forecasting property values to increase by 19% this year, followed by a 6% increase in 2022.5