SA Housing Market

South Australia’s housing market has proven to be a reliable location for property investment as prices across the state for both houses and units appear to be relatively stable with the potential for long term growth.

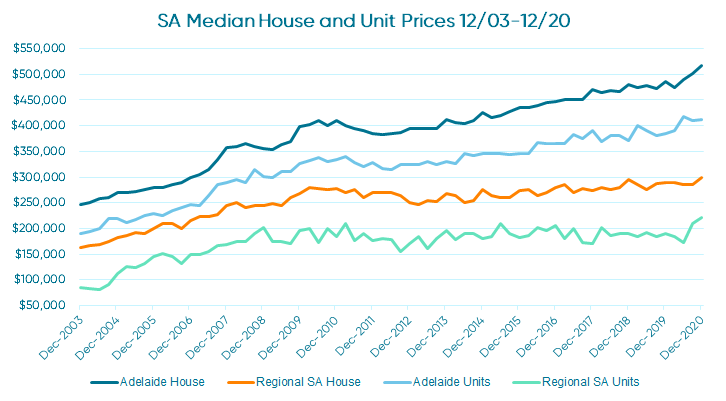

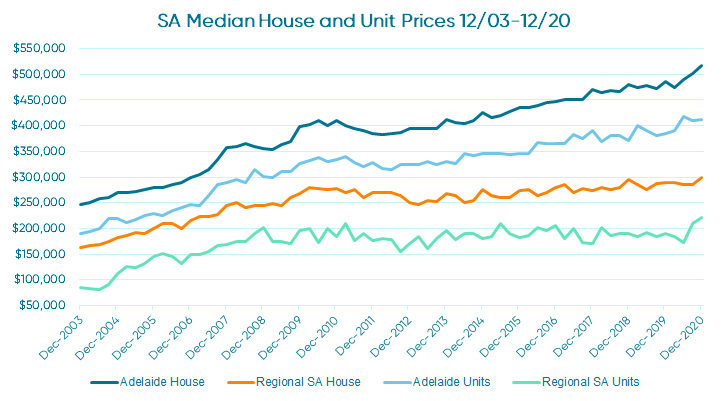

As the below graph indicates, SA’s property market, especially Adelaide, has historically shown a steady growth rate, with few major declines in the market.

While 2020 caused a shake up of most property markets across the country, South Australia performed particularly well with all of their markets showing an increase. In December 2020 houses in Adelaide and Regional SA, as well as units in Regional SA all recorded all time high median house prices.3 These increases in 2020 were led by units in Regional SA as they recorded a 16.47% growth in December 2020, compared to 2019 figures.4

Source: Median price (unstratified) and number of transfers (capital city and rest of state)

Source: Median price (unstratified) and number of transfers (capital city and rest of state)

So far in 2021 SA’s property market has continued to record new high’s in median house prices with the overall Adelaide property market seeing a 5.4% increase in the second quarter of 2021, while regional SA achieved a 2.7% increase in the same period.5

South Australia’s housing market continues to see new highs with no signs of slowing down, making now a great time to invest in property in this state.