Melbourne Property Market Update December 2020

2020 was a year to remember in more ways than one. For Melbourne’s property market, the beginning of the year looked as though housing values were on the up after a short period of uncertainty, with the average house price of Melbourne surpassing $850,000. Investors seized the opportunity of the dip in the market and longterm growth looked promising. However, no one could have possibly foreseen the pandemic and the ripple effects seen across the globe. Many predicted massive declines in prices in Australia’s capital cities, particularly Melbourne and Sydney, however the result was far less devastating.

As we get set to close the books on yet another year, it’s time to look back on our pre-COVID predictions and reflect on a year that was, and a year that wasn’t.

The effects of Melbourne’s lockdown, border restrictions, increasing unemployment, low population growth and the softening of the rental market saw the median house price tumble throughout the year. The positive news of relaxed restrictions, which stopped Victorians from buying, selling or leasing their properties over recent months, will ultimately see a return to real estate transactions in Melbourne.

Melbourne CBD

Undoubtedly, 2020 has been a year full of unprecedented events such as the bushfires, COVID-19 pandemic and the first recession in almost three decades. Reflecting on our prediction at the start of the year, it was believed that housing demand in the Melbourne CBD, particularly demand for apartments, would be steady due to strong migration, the appeal of Melbourne to international and interstate students and workers relocating closer to the business district. However, the arrival of COVID has driven the Melbourne CBD’s housing market in a different direction.

Due to the lockdown environment and remote working and learning restrictions, many young people have exited the rental market in the CBD and moved back in with their parents. Moreover, there has been a sharp decline in international student numbers due to the closure of the international border and the restrictions on international travel. All these factors have caused a spike in the vacancy rate which reached 10.6 per cent as of October 2020. Although the vacancy rate has reached its historical high, the median price of apartments in the CBD is relatively stable. According to the latest market insight by REIV, the median sale price of apartments in the CBD is $580,000, reflecting a growth rate of 2.7 per cent compared to the same quarter last year. Thanks to the historic low interest rate, mortgage repayment holiday and extension of JobKeeper, the housing market in the CBD is relatively resilient amid the COVID crisis.

South-East

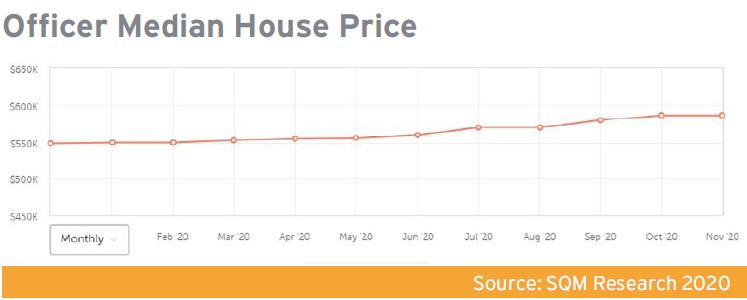

At the beginning of the year, we noted that there were a handful of locations that indicated strong growth potential in the south-eastern region of Melbourne. We predicted that Officer was one of the best suburbs in which to invest in 2020. The median house price was sitting at $549,000 at the start of the year.

Recent figures show that our predictions were correct. Amid the COVID crisis, the median housing price in Officer has recorded a growth rate of approximately 6.7 per cent. With affordable housing and land packages combined with historic low interest rates and several government incentives, more first home buyers are getting into the housing market and hunting for their dream house in a new estate. Apart from Officer, housing prices in other south-eastern suburbs such as Clyde, Clyde North, Cranbourne and Pakenham, also experienced positive growth during the whole year.

Although the housing market is filled with uncertainty, the housing market in the south-east region is relatively resilient. Due to the Home Builder Stimulus, we are also seeing high demand for vacant lots or house and land packages in the region.

Western Suburbs

In Melbourne’s west, areas such as Tarneit, Truganina, Melton and inner suburbs such as Williamstown and Essendon remained stable throughout the year despite the unprecedented times. The medium price in Tarneit for January 2020 was $550,000; in August it reached $560,000. Melton’s medium house price recorded the same price in August as it did in January, at $385,000. Williamstown’s median house price in January was $1.33 million and in August was $1.355 million. While these areas did not see the long term growth predicted at the start of the year, they also did not see the massive declines predicted when the pandemic reached Australia in March. The inner western suburbs saw little movement as fewer houses were placed on the market with owners not looking to part ways in a perceived declining market unless absolutely necessary. Developing areas such as Tarneit and Melton saw spikes in land sales with the offering of the government’s incentive in order to ease the blow of the pandemic on the housing and construction markets. Owner-occupiers and purchasers continue to dominate the market in these areas.

The rental market did suffer across the area however. With tough restrictions in place across metropolitan Melbourne, residents sought refuge in country Victoria or for housing larger than their current situation. The inner western suburbs experienced very low levels of rental occupancies given the price of the area and the uncertain financial position Victorians found themselves in. Areas such as Tarneit and Melton saw a steady amount of rental occupancies due in part to the larger land parcels and larger dwelling areas, desirable when facing lockdowns and other restrictions enforced by the government.

One interesting point made throughout this year was regarding the price of construction. At the start of the year, overall prices from volume builders started to decline in an attempt to be competitive and draw in business at a time when demand was lacking. Builders were forced to slash prices or package deals and inclusions for no extra cost in order to secure clients. Through the help of the government Home Builder grant, the price of construction contracts started to increase in line with the workload and return to the price point prior to the pandemic.

Overall, Melbourne’s western property market remained stable throughout an unpredictable and difficult year.

Inner and Outer East

At the beginning of the year, the market ramifications of the impending global pandemic were unquestionably unforeseen. Towards the end of 2019, the market in Melbourne’s inner and outer east corrected and the number of auctions and clearance rates increased, causing declining average days on the market and strong median prices. It was predicted that the increase in property prices would continue, with specific focus on suburbs to feature such growth including Box Hill, Glen Waverley, Ringwood and Ferntree Gully.

It was expected that a boom period was unlikely, however with the trend continuing from the second half of 2019 for auction rates and median prices, it was assumed a positive growth year for property owners in the eastern suburbs. Unfortunately, as has been well documented, this did not come to fruition. Restrictions imposed for property inspections and auctions caused clearance rates and auction numbers to tumble as vendors were forced to sell through virtual auctions or expressions of interest, and in cases where vendors were either adamant or desperate to sell, did so with a recorded discount of 12 per cent in Melbourne’s inner east.

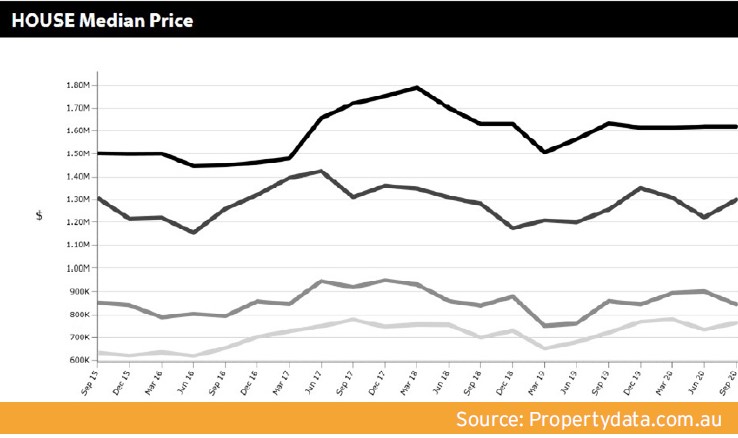

The above chart shows that median prices in the aforementioned suburbs levelled over the course of the year throughout the tough restrictions faced by metropolitan Melbourne and did not increase as predicted. Interestingly, prices remained relatively level after the upward trend seen at the end of 2019, indicating strong demand from buyers in these inner-city suburbs despite the low volumes across Melbourne and high withdrawal rates as vendors opted to hold off until restrictions eased.

Positive signs can also be found in the results from the end of October, the drop in COVID cases and subsequent easing of restrictions to a near normal life, leading to the highest weekly auction volume the city has experienced since July, with preliminary numbers showing a healthier clearance rate of 72.6 per cent (CoreLogic, 2020).

In Melbourne’s outer east, the Yarra Ranges LGA maintained an upward trend in annual median house price from Quarter 4 2019 to Quarter 3 2020 (PropertyData.com.au). The median house price increased from $666,000 (Quarter 4 2019) to $700,700 (Quarter 3 2020) in gradual increments throughout the year and this trend was experienced across all house types of two, three and four bedrooms, highlighting market resilience in Melbourne’s eastern corridor in 2020.

Inner and Outer North

It didn’t take long for that optimism and confidence in the market to be gone with news of the COVID-19 virus. This directly impacted the Victorian real estate market with agents not able to perform open houses let alone auctions and many vendors also hesitant to market their properties in an uncertain lockdown environment using new digital platforms. The stage 4 restrictions saw a 350 per cent dip in auctions in the month of September 2020 compared to that of September 2019 (Corelogic, 2020) and this considering September is the start of the spring selling period which usually sees the highest number of listings during the year.

Although the number of listings in Victoria were down, property in the outer north, particularly new land under $350,000 and house and land packages under $600,000, saw a boom compared to the rest of the market. Many developers in the Donnybrook, Kalkallo and Mickleham areas said they have had some of their busiest months of all time this year even during the stage 4 lockdown. The driving factor for the strong result in this area of the market was the homeowner’s building grants introduced by the federal government making buying more affordable, especially for first home buyers.

The inner north saw listings down in line with the rest of the market during the peak of the COVID-19 restrictions, but surprising to many was the consistently strong sales coming from inner northern suburbs such as Coburg, Fitzroy and Northcote in the $1 million to $1.75 million price range. This was the result of a number of willing and able buyers competing over limited stock which saw many sale results in line with pre COVID prices, a surprise to many in the industry.

However, one of the biggest surprises in the property market was the ability of the industry to adapt and overcome the challenges of operating in a lockdown environment. With restrictions on auctions and open houses, the ability of agents, vendors and buyers to operate on a digital platform and participate in auctions and open houses is something that will continue to become more normalised in a COVID normal world especially as the technology develops further and acceptance grows by both sellers and buyers.

Geelong

Despite the impact COVID has had on the market, the February predictions for the Geelong region have proven to be true. Looking back, it was predicted that growth would be moderate over the course of the year, forecasting an increase of five to eight per cent. This call was close to the mark as the median dwelling value grew from $560,000 in February to $615,000 in November 2020, a nine per cent increase over the year.

This growth is due to a myriad of factors, including reduced interest rates, easing of borrower serviceability, improved housing affordability and the first home buyers grants making it easier for new homeowners to enter the market. Strong employment sectors such as government, education, health and finance, along with buyers choosing to escape central locations and prioritising lifestyle locations have made certain that the Geelong property market has remained strong despite the trying times.

In more recent months, especially since restrictions have eased, Melbourne residents have flooded the market and are snapping up properties, particularly higher end stock. This is evident as Bellarine Property agents have reported only five current listings for the Barwon Heads region, down roughly 60 per cent from the same time last year. This aligns with a trend also experienced on the Mornington Peninsula.

Arguably, the most surprising thing to occur in the Geelong region this year is the sale price records.

The sales record was broken twice during 2020. The first was a $7.25 million price for a Lorne home in January. This record was recently broken by an exclusive residence overlooking Barwon Heads’ renowned golf club. While the final price has not been revealed, local property agents have confirmed that the sale price for the property at 2 Stephens Parade has broken the previous record.