New sign the property market downturn could be over, with home prices rising in March

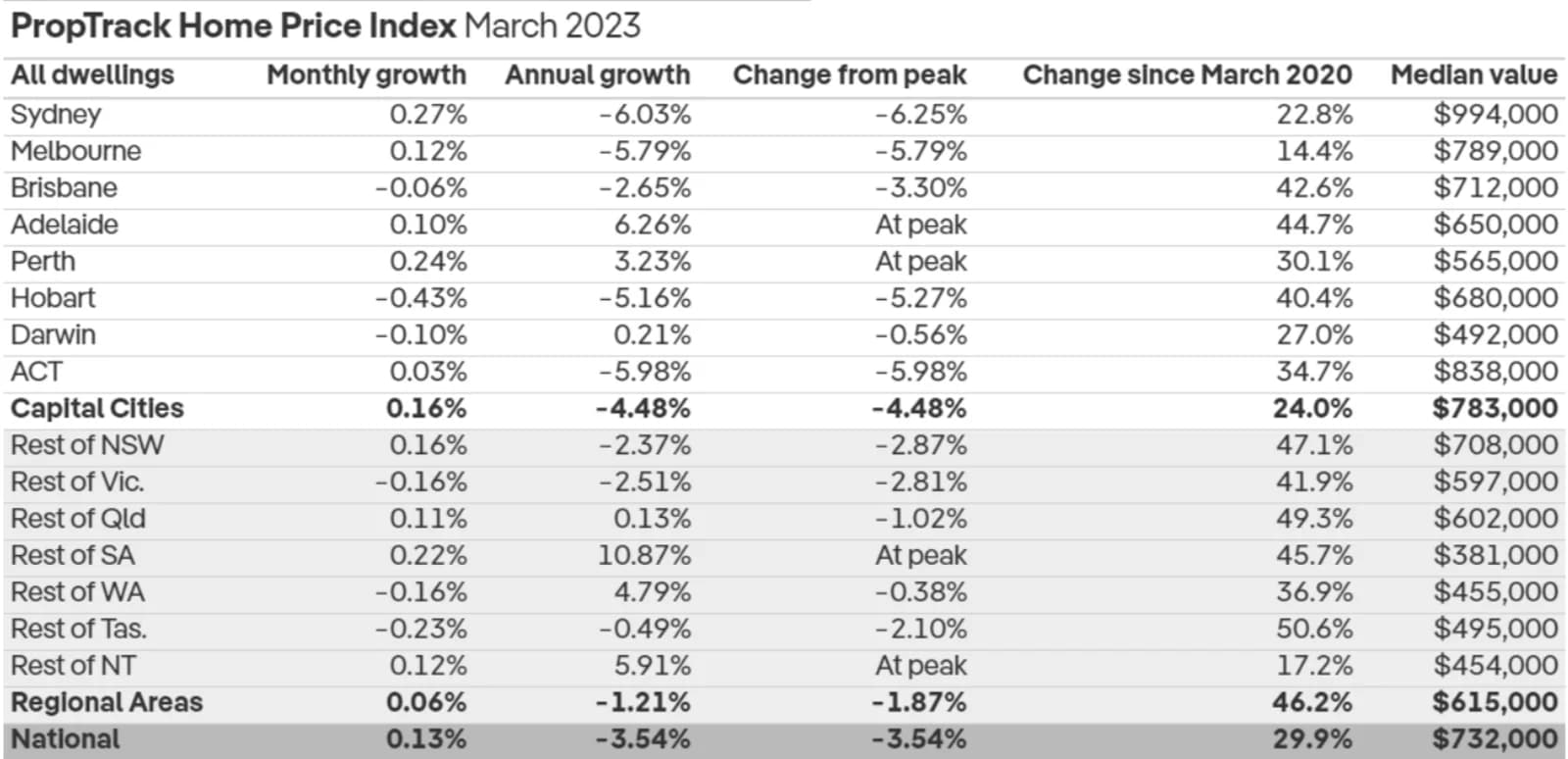

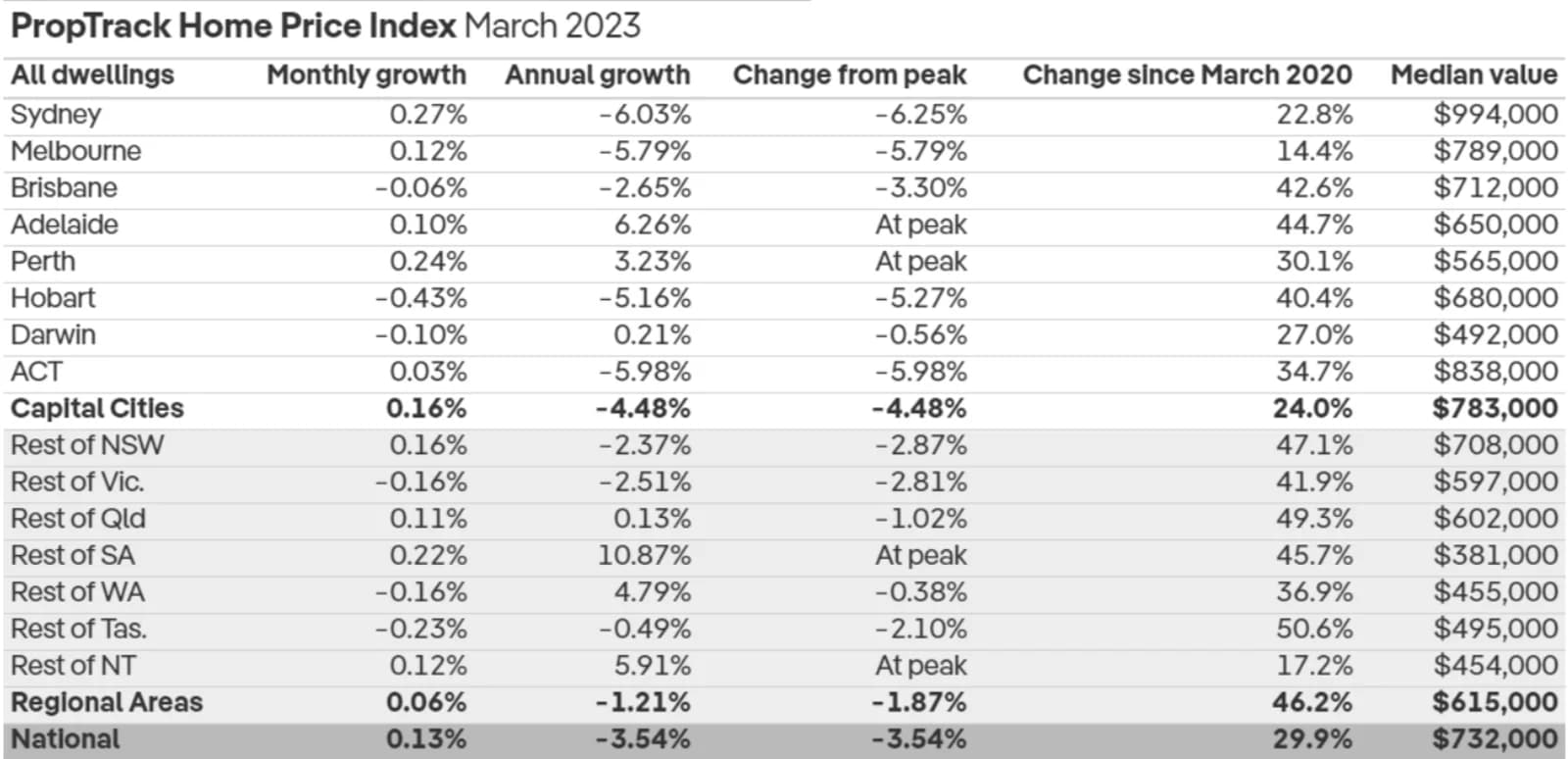

The latest PropTrack Home Price Index shows property values were up in most capital cities last month, with a shortage of properties for sale counteracting pressure from steep interest rate hikes.

Sydney saw a 0.27% lift in home prices followed closely by Perth with a 0.24% increase, while Melbourne’s market rebounded by 0.12%.

Prices were up 0.1% in Adelaide and very marginally by 0.03% in Canberra.

Meanwhile, there were slight falls in Brisbane, down 0.06%, as well as Hobart, down 0.43% and Darwin, down 0.1%.

At a national level, home prices lifted slightly by 0.13% in March and are now 0.49% higher this year, PropTrack senior economist Eleanor Creagh said.

“The downward trend has reversed,” Ms Creagh said. “We saw price falls easing into the end of 2022 and now things are moving upwards again.”

Prices across much of the country began falling from their peaks in the first half of last year on the back of rapid interest rate increases by the Reserve Bank.

But in more recent months, that impact has been significantly blunted, Ms Creagh explained.

“Even though buyer demand is weaker than peak levels, softness in new listing volumes and tight supply have offset this,” she said.

“That’s led to a pickup in competition among potential buyers, buoying home values”.

“So, even with a significant reduction in borrowing capacities and a deterioration in housing affordability due to higher mortgage repayments, the severe undersupply of homes for sale is counterbalancing that.”

“Several other positive demand drivers are also helping to offset downward pressure on prices, including a strong rebound in immigration, very tight rental markets, and slowly increasing wages,” she added.

“If the RBA pauses its rightening cycle this month or next, the bottoming out process may continue, with home prices stabilising further.”

“An end to rate hikes will also reduce some of the uncertainty that’s kept buyers sitting on the fence, boosting confidence.”

“However, headwinds still remain,” Ms Creagh said.

“The full impact of rate rises is yet to be felt. This means the decline in prices could still find a second wind, particularly if new listing volumes increase in the coming months.”

Even though prices are down from their peaks, they remain 29.9% higher at a national level then pre-Covid.

Originally published as New sign the property market downturn could be over, with home prices rising in March