RBA delivers supersized rate hike ahead of winter power price surge

Households are already feeling the squeeze from higher food, petrol and housing costs, which have driven inflation to a two-decade high1.

As winter sets in, another source of financial pain is also looming with supply constraints of gas and electricity expected to drive power bills higher.

In its June board meeting, the RBA raised the official cash rate by 50 basis points to 0.85% and flagged further rate hikes were on the way.

“Inflation in Australia has increased significantly,” RBA governor Philip Lowe said in his post-meeting statement.

“Global factors, including COVID-related disruptions to supply chains and the war in Ukraine, account for much of this increase in inflation.

“But domestic factors are playing a role too, with capacity constraints in some sectors and the tight labour market contributing to the upward pressure on prices. The floods earlier this year have also affected some prices.”

PropTrack economist Paul Ryan said the extra-large rate hike – which is double the size of a typical 25 basis point move – signals the RBA is further behind the inflation curve than they anticipated.

“This larger than ‘business-as-usual’ hike indicates the RBA is increasingly concerned about domestic inflationary pressures and has assessed that they need to increase rates quickly to get them under control,” Mr Ryan said.

Mortgage Choice national sales director David Zammit said surging inflation, strong economic growth and low unemployment supported the conditions for further rate increases.

“Last month the Reserve Bank sent a clear message to Australians that it had started on a path towards normalising monetary policy and further rate rises may be required,” Mr Zammit said.

While many people built up significant savings buffers and got ahead of their mortgage repayments during the pandemic, PropTrack economist Paul Ryan said higher costs would still put pressure on household budgets in the months ahead.

“You've got this incredibly fast inflation that's increasing the price of groceries, energy, and lots of essentials that people can't substitute away from,” Mr Ryan said.

The most recent Consumer Price Index data by the Australian Bureau of Statistics showed annual inflation reached 5.1% in the first three months of 2022.

However, this was driven by price rises in ‘non-discretionary’ or essential household items, which surged 6.6% over the year – more than twice the rate of discretionary inflation (2.7%)2

Borrowers seek out a better deal

With lenders quick to pass on last month’s rate hike to variable-loan customers, Mortgage Choice loan submissions data shows borrowers are shopping around for a better deal.

During the month of May, 41% of all new loans submitted through Mortgage Choice were for refinancers, up from 38% in April.

“Interest rates may be rising but there are still some great deals in the market and your broker can help you find them,” Mr Zammit said.

Recent lending data by the Australian Bureau of Statistics showed refinancing activity in April was 19.2% higher than the same time a year ago1, as borrowers looked to get ahead of rising mortgage costs.

“With the cost of living rising rapidly, Australians will be questioning how to lessen the burden on their hip pockets, getting a better deal on your home loan is a great place to start,” Mr Zammit said.

“My advice to borrowers and prospective buyers is to speak to a mortgage broker to ensure you’re getting the right loan for your needs.”

Talk to your local broker today

Request a callHousing market cools

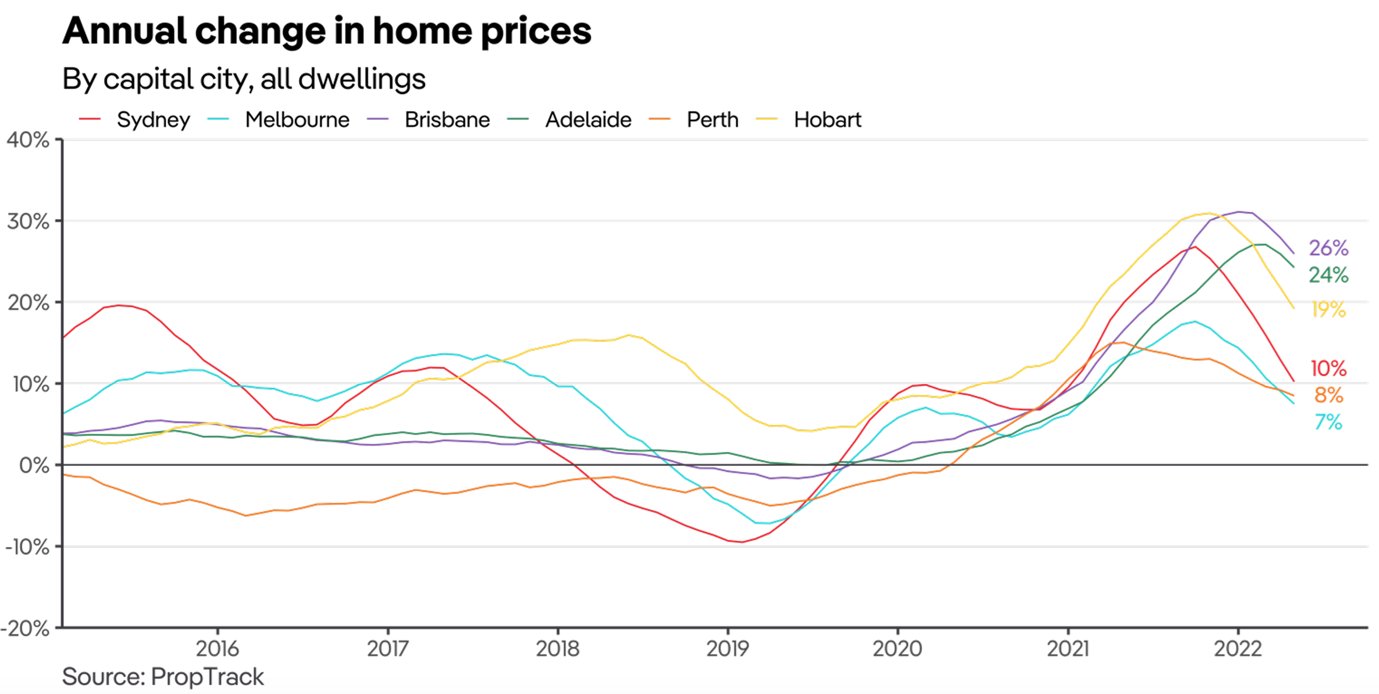

With further rate rises on the way, Mr Ryan said national property prices continued to slow as buyers factored higher mortgage repayments into their purchasing decisions.

The latest PropTrack Home Price Index showed national property prices fell 0.11% in May4, marking the first decline since the start of the COVID-19 pandemic.

“Housing price growth has slowed significantly, with annual price growth falling from 24% six months ago to only 14% in the year to May,” Mr Ryan said.

“This slowdown has particularly affected the most expensive capital city markets of Sydney, Melbourne and the ACT, which recorded price falls in May.”

Mr Ryan said just how high interest rates reach by year-end is a key source of uncertainty for the housing market.

Australia’s big four banks expect the cash rate to reach between 1.35% and 1.75% by the end of 2022, before climbing further over 2023.

“There’s a lot of uncertainty for price growth because of higher interest rates, so people are bidding less aggressively than they had been last year, and we’re likely to see that continue,” Mr Ryan said.

“This higher-than-expected increase in the cash rate by the RBA will be taken cautiously by buyers and will likely impact sentiment.”

However, he noted buying activity still remains strong.

“I think sellers are confidence because campaigns haven't been interrupted by lockdowns over 2022 and we continue to see lots of buyers in the market as well that are willing to buy at current prices.”

“I think it's worth noting that prices are still up 35% nationally since the start of the pandemic, so the small falls or the slower growth that we're seeing now isn't the bigger picture for them.”

1 https://www.abs.gov.au/statistics/economy/price-indexes-and-inflation/consumer-price-index-australia/mar-2022#main-features

2 https://www.abs.gov.au/statistics/economy/price-indexes-and-inflation/consumer-price-index-australia/mar-2022#overview

3 https://www.abs.gov.au/statistics/economy/finance/lending-indicators/apr-2022

4 https://www.realestate.com.au/insights/proptrack-home-price-index-may-2022/