RBA raises cash rate to seven year high but full impact yet to be felt

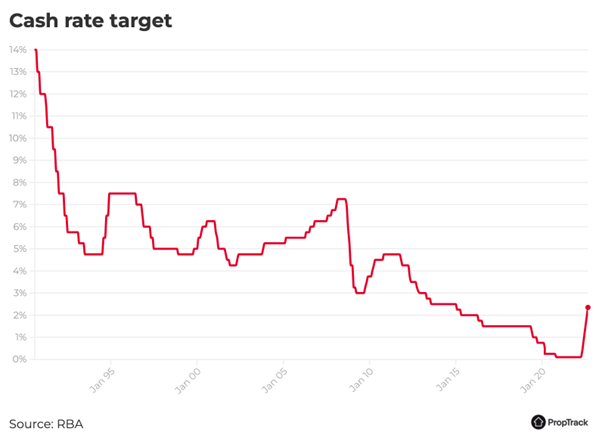

The Reserve Bank of Australia raised the cash rate by 50 basis points to 2.35% in September1, the fifth increase in as many months in an attempt to get inflation lower.

In his monthly statement following the decision, RBA governor Philip Lowe said the latest increase would help bring inflation back to its 2-3% target range.

“Inflation in Australia is the highest it has been since the early 1990s and is expected to increase further over the months ahead,” Mr Lowe said.

“The further increase in interest rates today will help bring inflation back to target and create a more sustainable balance of demand and supply in the Australian economy.”

Inflation reached 6.1% over the year to June2, well above the RBA’s 2-3% target range, as the cost of fuel, construction, food and furniture rose sharply.

“The board expects to increase interest rates further over the months ahead, but it is not on a pre-set path,” Mr Lowe said.

“The size and timing of future interest rate increases will be guided by the incoming data and the board's assessment of the outlook for inflation and the labour market.”

The official cash rate has now surged from 0.1% to 2.35% since May, the fastest pace of tightening since 19943.

If each rate hike is passed on in full, a borrower who took out an average new home loan of $611,000 in April – when the cash rate was still 0.1% – could see their mortgage repayments jump by nearly $800 a month, according to analysis conducted with the Mortgage Choice home loan repayment calculator.

However, economists say many borrowers won’t see the full impact of these hikes on their cashflow until around Christmas.

According to Gareth Aird, head of Australian economics at CBA, the lag between each rate hike and the time it takes to hit a borrower’s repayments is around two to three months across the major lenders.

“This means that the bulk of our borrowers have only felt the impact of one 25 basis point hike on their cash flow, or potentially as of this week the cumulative impact of the May 25 basis point rate hike and June 50 basis point rate increase,” Mr Aird said.

As a result, consumer spending has held up, for now, although PropTrack senior economist Eleanor Creagh said spending would likely slow in the months ahead.

“Given the lagged effect of rate rises, large share of variable rate borrowers ahead on repayments and borrowers on fixed terms yet to expire, many mortgage holders are yet to see their minimum repayments increase,” Ms Creagh said.

“As this changes and households are forced to make budgetary adjustments discretionary spending will likely slow.

She said the September rate hike would increase borrowing costs and reduce maximum borrowing capacities, adding downward pressure on property prices.

“The level of interest rates will be a key factor of housing market conditions and the pace and depth of home price falls in the period ahead,” Ms Creagh said.

The combined cost of the rate hikes so far

Once the combined 225 basis points worth of rate hikes flow through to mortgage repayments, borrowers face a steep jump in their monthly repayments.

Nationally, the average new home loan taken out in April was $611,000, according to the Australian Bureau of Statistics4. Assuming their lender passed on reach hike in full, these borrowers would face an extra $791 in monthly repayments to service the same mortgage.

In Australia's most expensive state, New South Wales, where the average new home loan size was $786,035, repayments could surge by more than $1000 a month.

Here’s a snapshot of how much the combined rate hikes so far could cost borrowers who took out an average sized home loan before the first rate hike.

|

Combined interest rate increase of 225 basis points |

|||

|

|

Average new loan size (April) |

New monthly repayment |

Repayment increase |

|

National |

$611,154 |

$3,322 |

$791 |

|

NSW |

$786,035 |

$4,273 |

$1,018 |

|

Vic |

$637,268 |

$3,464 |

$825 |

|

QLD |

$527,452 |

$2,867 |

$683 |

|

SA |

$467,285 |

$2,540 |

$605 |

|

WA |

$471,489 |

$2,563 |

$610 |

|

ACT |

$596,321 |

$3,241 |

$772 |

|

Tas |

$447,778 |

$2,434 |

$580 |

|

NT |

$426,977 |

$2,321 |

$553 |

In these calculations, the borrower is assumed to be an owner-occupier paying principal and interest with 30 years remaining on their loan. It assumes an initial average variable interest rate of 2.86%, according to April RBA figures5. It assumes each rate hike is passed on in full. The calculation does not factor in loan fees and charges, or any principal paid down over time.

Economists at the big four banks expect the RBA will continue to lift the cash rate in the months ahead, although the pace of hikes is unclear.

ANZ and Westpac expect another 100 basis points worth of rate hikes, to reach a peak cash rate of 3.35%.

CBA economists anticipate only one more rate hike of 25 basis points, with a terminal cash rate of 2.6%.

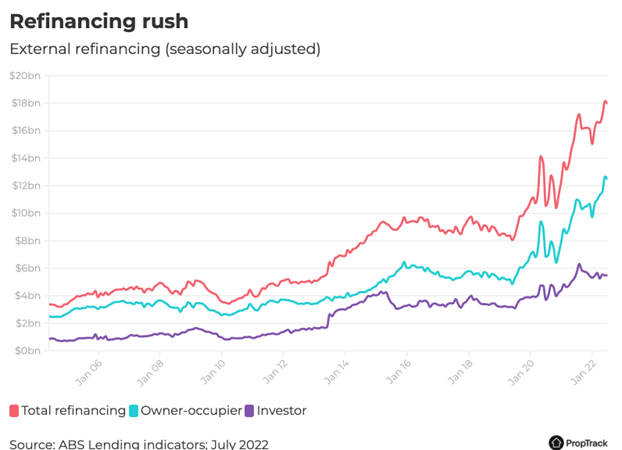

With uncertainty over just how high interest rates will rise, many borrowers have been proactively seeking out a more competitive home loan.

ABS lending data shows nearly $18 billion worth of home loans were refinanced to a different lender in July, just below the record set in June.

Mortgage Choice chief executive Anthony Waldron said it’s a good time for borrowers to work with their brokers to review their home loans and get a more competitive deal.

“Many lenders are offering cash-backs to entice borrowers to switch and attractive home loan rates for new customers,” Mr Waldron said.

“It’s worth chatting to your broker about whether there’s a more competitive home loan out there for you.”

1 https://www.rba.gov.au/media-releases/2022/mr-22-28.html

2 https://www.abs.gov.au/statistics/economy/price-indexes-and-inflation/consumer-price-index-australia/latest-release

3 https://www.smartline.com.au/mortgage-news/interest-rates/rba-raising-interest-rates-at-breakneck-speed-but-are-we-nearing-the-peak/

4 https://www.abs.gov.au/statistics/economy/finance/lending-indicators/apr-2022

5 https://www.rba.gov.au/statistics/interest-rates/