Over the past few years, Brisbane’s housing market has grown into an ideal area for property investors. With recent and upcoming developments put in place to improve its infrastructure and economy, as well as the upcoming 2032 Olympic games set to be held in Brisbane, now may be a prime opportunity to invest.

Brisbane property investment update 2022

Brisbane Housing Market

When investing in property, an understanding of a location's housing market in relation to current and previous trends can be beneficial. Although historically the Brisbane housing market has not seen the same increases as Sydney and Melbourne, recent trends are showing that the property market is expected to continue to see high growth rates.

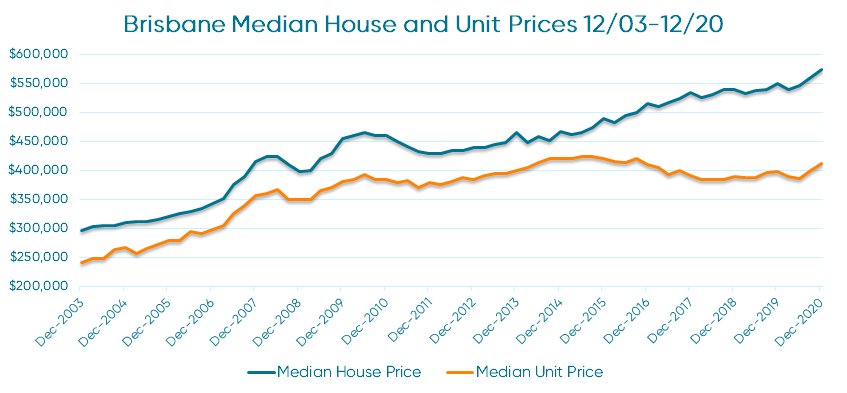

The median house price in Brisbane has increased over the past 17 years from $296,400 in December 2003 to $575,000 in December 2020. Historically Brisbane’s housing marking has performed well through seeing a gradual increase in the median house prices most years. As shown below it is clear that houses perform better than units in Brisbane and are likely to see more growth over time.

Source: Median price (unstratified) and number of transfers (capital city and rest of state)

As indicated in the above graph, despite the coronavirus pandemic, the median house and unit price in Brisbane has increased in 2020. As of March 2021, Brisbane’s housing market is recording 6.84% growth year on year on Corelogic’s Home Value Index3.

Despite the impact of COVID-19, the Brisbane housing market has managed to maintain steady levels of growth that could be attributed to the record low interest rates in the market, government incentives and Brisbane’s overall handling of the pandemic. In December 2020, 85% of Brisbane’s suburbs recorded annual growth4.

Based on the historical data and current market trends, we can expect to see the Brisbane property market continue to grow. A recent report by Westpac5 has forecasted that property prices are expected to increase by 20% in Brisbane over the next 2 years. This makes now a great time to enter the market by investing in property in Brisbane.

Planning to invest? Get your free home loan quote today.

Get startedBrisbane Economy and Infrastructure

As Australia’s third largest capital city, behind Sydney and Melbourne, Brisbane has established itself as a major hub for business, education and technology. This makes it an ideal location for investing in property as it’s already a prominent capital city, whilst still having major growth potential.

Despite a hit to the economy that all cities across the country took due to COVID-19, Brisbane has been able to see a recovery in their economy by launching an economic recovery taskforce to address the impacts of coronavirus on the economy and the community.

Brisbane's response to boost and rebuild their economy is being tackled with four main priorities:

These initiatives are just the beginning of Brisbane’s economic recovery plan6 to bounce back from COVID-19 and maintain the growth in Brisbane’s economy that has been experiencing.

One major component of Brisbane’s economic recovery plan as mentioned above is the millions of dollars being put in major infrastructure projects that are currently in progress or well into the planning stages. These projects will provide a massive boost to Brisbane’s economy by providing vital employment and increasing the overall livability of the city, which will in turn result in a greater growth potential when it comes to investing in property.

Brisbane Rental Yields

Rental yield is one of the most important figures to understand when investing in a property. It is essentially the amount of money you make on an investment property by measuring the gap between your overall costs and the income you receive from renting out your property.

By having an understanding of the rental yield in the area you want to invest, you will be better equipped to find the right investment property for your situation. 2020 saw an increase in interstate migration in Brisbane, which has resulted in one of the strongest rental markets for the city.

As of February 2021, the rental vacancy rate has reach a record low of 1.5%7, resulting in record high median rent prices of $478 for houses and $328.80 for units. As the demand for Brisbane continues to increase, we can expect the vacancy rates to remain tight as rental properties popularity increases.

As of March 2021, Brisbane’s current gross rental yield for houses is at 3.7% and for units at 5.2%8. This can be attributed to the growing demand for rental properties in Brisbane and the affordability of both units and homes when compared to other capital cities such as Sydney and Melbourne.

Property investor guide

If you are looking to invest in property or simply exploring the possibilities, this guide will help you navigate the steps involved to kickstart your property investment journey.

Best Areas to Invest in

There are of course many suburbs in Brisbane that are great locations to begin or build your investment portfolio. Through our analysis of the Brisbane property market, we have identified suburbs in the high, medium and low end that may be a great opportunity to begin your investment journey with. These 3 suburbs were chosen due to their proximity to the CBD, historical property growth and potential rental yields and may serve as a guide that we believe can provide strong results if you’re looking to invest in property.

How to Invest in the Brisbane Property Market?

Once you’ve decided Brisbane is the right market for you to invest, it’s time to look at getting an investment home loan to start your journey.

If this is your first investment property we have created a beginners guide to outline the main factors you need to consider and the costs involved with an investment property here.

When you are ready to start your investment home loan application, it is best to understand what type of loan is right for you and the associated rates. You can compare investment loans across multiple lenders from our panel here or speak to a Mortgage Choice Broker who can go through your situation, compare the loan available and find the loan that’s right for you.

We are here to help

Of course this is only a starting point, as there are many areas in Brisbane that can offer similar or greater investment opportunities. If you’re interested in investing in Brisbane and are ready to get the process started, it is best to speak with your local Mortgage Choice broker to get expert advice on your property investing journey.