Federal Budget 2022: What it means for you, your home and your business

How is the economy shaping up?

The Federal Budget is forecasting the Aussie economy to grow by 4.25% in 2021/22, with growth of 3.5% the following financial year1.

Importantly, the unemployment rate is expected to drop to 3.75% in the September quarter of 2022. If this happens, it will be the lowest level in almost 50 years2.

A tight labour market is expected to see wages growth accelerate to its fastest pace in almost a decade, with average earnings per hour forecast to increase by 5% through the year to the June quarter of 20223.

The bottom line is that the outlook is positive for workers and businesses. But what does the Budget hold for you?

One-off cost of living tax offset

Plenty of Australians have felt the impact of rising prices thanks to inflation hitting 3.5%.4

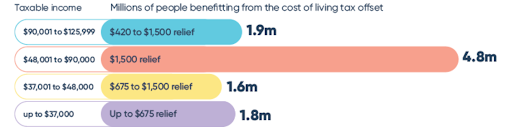

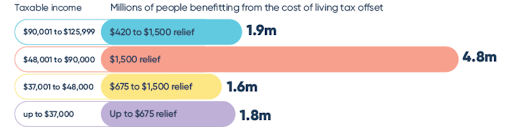

To help ease cost of living pressures, the Budget announced a one-off $420 cost of living tax offset for low to middle income earners available from 1 July 2022.

Remember, this is a tax offset – not a cash payment, so it means a possible tax saving rather than cash in hand, and it’s only available to those earning under $126,000 annually.

A $250 tax exempt payment will be made to pensioners and welfare recipients.

As the graph below shows, if your taxable income is between $48,001 and $90,000, you could receive up to $1,500 in tax savings through the low and middle income tax offset combined with the $420 cost of living offset. Bear in mind, this won’t kick in until 1 July 2022, so the hip pocket benefits won’t flow until next financial year.

Tax relief from the cost of living tax offset and LMITO

Temporary relief at the bowser

Russia’s invasion of Ukraine has sent fuel prices skyrocketing, adding to cost pressures for Australian families and businesses.

The Federal Budget has introduced a temporary cut to fuel excise, which will be reduced by 50% but only for six months.

This will see excise on petrol and diesel cut from 44.2 cents per litre to 22.1 cents per litre, lowering prices at the bowser.

The Budget gives the example of how a small business with a fleet of 11 cars, all refuelling on a fortnightly basis, could save up to $2,780 in excise and GST expenses over the 6-month period that the reduced excise applies.

Help for first home buyers

The Budget announced an increase in the number of places available through the Home Guarantee Scheme. For the three years starting 2022-23, 50,000 places will be available to support home buyers purchasing a home with a low deposit.

The Home Guarantee Scheme provides5:

- 35,000 places annually for the First Home Guarantee (formerly the First Home Loan Deposit Scheme). This allows eligible first home buyers to get into the market with 5% deposit and no lenders mortgage insurance (LMI).

- 5,000 places per year to 30 June 2025 for the Family Home Guarantee, available to single parents buying a home with 2% deposit and no LMI

- 10,000 places annually to 30 June 2025 for a new Regional Home Guarantee. This will support buyers who haven’t owned a home for five years to purchase a new home in a regional location with a minimum 5% deposit and no LMI.

Ready to buy your first home? Get your free home loan quote today.

Get startedSavings for small businesses

The Budget announced $1 billion in tax relief for a new Technology Investment Boost to encourage small businesses to go digital.

Small businesses with annual turnover less than $50 million will be able to claim a bonus 20% tax deduction on the cost of expenses and depreciating assets that support digital uptake. This includes portable payment devices, cyber security systems or subscriptions to cloud-based services.

The boost will apply to eligible expenditure of up to $100,000 annually, incurred from Budget night (29 March 2022) until 30 June 2023.

Small businesses will also have access to a new 20% bonus tax deduction for eligible external training courses. The ‘Skills and Training Boost6’ will apply to training costs incurred from 29 March 2022 until 30 June 2024.

It’s worth noting, with a Federal election looming, these measures hinge on the Morrison Government being re-elected. Time will tell as to whether that happens.

1 https://budget.gov.au/2022-23/content/bp1/download/bp1_2022-23.pdf

2 https://budget.gov.au/2022-23/content/bp1/download/bp1_2022-23.pdf

3 https://budget.gov.au/2022-23/content/bp1/download/bp1_2022-23.pdf

4 https://www.rba.gov.au/

5 https://budget.gov.au/2022-23/content/bp2/index.htm refer Budget Paper No. 2: Budget Measures

6 https://budget.gov.au/2022-23/content/overview/04_workforce.htm